When it comes to watching insiders and following their lead, you must dig deep to unlock the true answers. Inflation is the risk. Commodities are the cure.

As US markets melt up. Buffett’s hanging up his hat.

I don’t think investors are paying enough attention to this.

As you might remember, the world’s most successful investor handed over the reins of his investment baby, Berkshire Hathaway, earlier this year.

Was it age, or was it something else?

Remember, Buffett’s decision to retire came AFTER he had sunk record volumes of Berkshire’s assets into short-term US Treasuries.

Effectively cash.

Does this mean Warren sees the proverbial hitting the fan in US markets in the not-so-distant future?

While Buffett is often a little too early in his positioning… Ultimately, he’s almost ALWAYS proven right.

Meanwhile, another billionaire investor, Ray Dalio, is making similar moves, deleveraging exposure to US stocks.

In a filing earlier this month, Dalio’s fund showed reductions in its exposure to the US S&P500.

But also hedging against the US dollar by increasing exposure to the SPDR Gold Shares ETF (GLD). An exchange-traded fund that tracks the price of gold bullion.

What could all this mean?

I often say to my paid readership group that it pays to watch insiders.

We’re not privy to the inside deals and connections at the highest levels, so why not watch where the big money flows and invest accordingly?

In mining, that means following names like Reinhart, Forrest, or Friedland…

The bigwigs in the industry who are privy to more information than any of us could dream of!

To show you what this looks like, here are some examples of how we’ve made that work for us…

At my paid advisory service, we followed the notoriously successful mining group, the Lundins, into a stock called NGEx Minerals [TSX-V: NGEX].

An Argentinian copper play that few know about here in Australia… We’re now up almost 250% on that one.

Another example of an insider we followed was Bill Beament, co-founder of Australia’s largest gold producer, Northern Star.

We invested early in Beament’s ‘side venture,’ Develop Global [ASX: DVP].

A zinc-copper play that’s surged this year thanks to Beament’s technical intuition… A bloke who knows how to build underground mines!

Neither copper nor zinc miners are in a bull market, yet both stocks have surged.

And that’s the value you can capture by following insiders—putting the odds in your favour even when market conditions aren’t favourable.

So, how does that relate to the biggest hitters in financial markets?

For anyone who bothers to pay attention, neither Buffett nor Dalio is terribly optimistic about the long-term outlook for the US economy.

With his record allocation to cash and decision to retire from Berkshire, Buffett hasn’t left much comfort for investors—at least those who care to pay attention.

Meanwhile, Dalio isn’t leaving anything to the imagination, explicitly warning investors about the risks to the US economy.

Whether it’s Buffett’s departure from Berkshire and giant cash piles or Dalio’s decision to sell US assets in favour of gold, BOTH of these investing titans are sounding the alarm.

Through words AND their actions.

So, what’s the big risk here?

Dalio is anticipating higher inflation, lower growth, and higher unemployment in Western economies… Symptoms of stagflation.

The economic conditions that afflicted the 1970s.

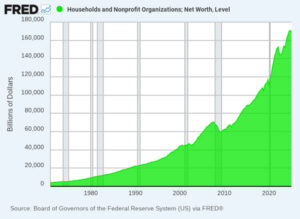

This was one of the most challenging decades for investors to navigate… Cash and equities performed poorly.

Thanks to the combination of high inflation AND low growth, investors struggled to maintain their wealth.

Most asset prices went backwards, in real terms.

But one asset class emerged as a proven winner in the 1970s

And it’s an area that Dalio is especially interested in right now… Commodities.

Adjusted for inflation, copper, nickel, coal, uranium, gold, oil and gas prices reached historic levels at different times during the 1970s.

In many cases, reaching prices that remain UNBROKEN today.

In my mind, it pays to watch these insiders carefully and follow their lead—not just listening or reading to what they have to say but acting with REAL conviction.

And from what I can tell…

ALL roads (from now on) will lead to commodities.

If you think these insiders are right, you can join me and find out which resource stocks I’m recommending to my paid readership group, here.

Until next time.

Regards,

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

All advice is general advice and has not taken into account your personal circumstances.

Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.