You’ll likely make better money, with less stress, leaning into companies showing strength already. We’re going to leave the resource market aside for now because I’m noticing positive action elsewhere too.

Yesterday we chatted about how uranium firm Boss Energy ($BOE) took a hiding on Monday.

Tuesday and it was gold stock Greatland Resources ($GGP) that copped a shellacking (-24%) after missing its previous guidance.

Even a barnstorming gold price can’t help when that happens.

Such is the cut and thrust of the resource market.

Here’s a stock market tip.

Don’t go ferreting around GGP and BOE for a ‘bargain’ price. At least, not yet.

It takes a while for momentum and enthusiasm to come back into stocks that cop a big drubbing like these two. It will likely take a quarter or two to get back on track.

If you’re interested in resource shares, tune into my colleague, geologist James ‘the Coops’ Cooper.

Hanging with Mr Cooper can be very profitable!

Today you and I will chat about companies releasing what we want to see: good results!

You’ll likely make better money, with less stress, leaning into companies showing strength already.

We’re going to leave the resource market aside for now because I’m noticing positive action elsewhere too.

It’s in small finance companies.

Context is important here, like always.

Non banks and BNPL shares took a drubbing from 2022-2024.

Higher rates, weak consumer confidence, a dodgy bad debt outlook, slowing revenue…all these factors combined to send them into the market sin bin.

They’ve lagged the recovery in the big bank stocks by a country mile.

Now we see green shoots really poking through.

Zip Co ($ZIP) is up over 100% since the April share market rout….

|

|

|

Source: Market Index |

I’d say Zip is odds on to break that $3.50 high set last year sometime in the next 6 months.

Then consider the recent update from Plenti ($PLT). It showed…

- Record loan portfolio (assets)

- Quarterly loan originations up 44% year-on-year

- Credit losses down

- Debt costs down

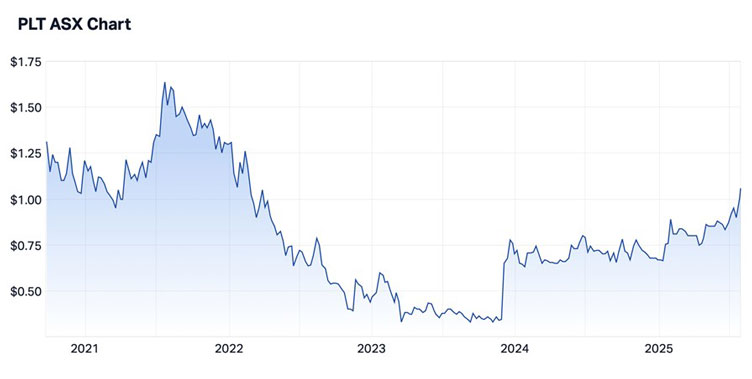

The stock is up 55% for the year. Check it out…

|

|

|

Source: Market Index |

Over at microcap Wisr ($WZR) good things are happening.

The CEO said yesterday…

“We are extremely pleased with our Q4FY25 results, which capped off a standout year for Wisr.

“We delivered our third consecutive quarter of loan book growth and our fifth straight quarter of loan origination growth, finishing the quarter with $140.3M in new loans originated across our personal and secured vehicle products.”

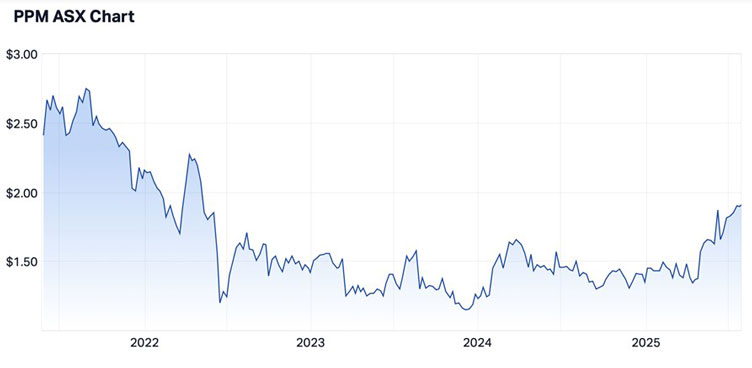

And my old favourite Pepper Money ($PPM) is into 52 week highs… (shout out to Ryan Dinse)…and keeps being floated as a possible take over target.

|

|

|

Source: Market Index |

What is going on here?

Clearly, consumers are borrowing money. This industry sells car loans, personal loans, green loans, mortgages…

They can only grow as businesses if credit is expanding.

That can only come from consumer employment, confidence and investment.

In turn, these companies need to raise the money the lend from the capital market.

The fact they’re getting better margins means investors are happy to give better pricing on this risk.

All in all, it’s hard to read this as anything but positive. There are opportunities in these shares, no doubt. But it’s also a handy ‘macro’ guide.

I put more importance on this market signal than any piffle I hear from an economist.

The share market is pricing in a better 12 months ahead for these shares. They are extremely sensitive to economic conditions on the ground.

If you’re waiting around for the economy or the share market to crumble, this suggests you’ll be waiting a good while, absent a wildcard.

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

***

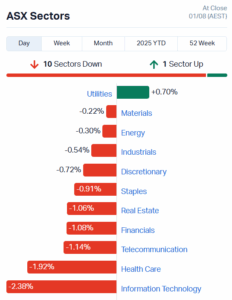

Source: Tradingview

The most interesting thing to occur since Trump signed a deal with the Europeans on the weekend, is that the Euro has fallen against the US Dollar.

Many think the deal is lopsided in favour of the US and will end up costing Europe dearly.

There has been a strong rise in the Euro since the start of the year. Investors started to allocate some money away from the US and towards Europe and Japan as a result of fears in relation to Trumps tariff policies.

The Euro jumped 15% from depressed levels near parity with the US dollar.

When you go to a bird’s eye view to see how the Euro has faired over the past 17 years, you can see a clear downtrend in play.

I have marked each occasion in the downtrend when the Euro has bounced into the sell zone of the previous wave and then met serious selling pressure.

The blue arrows show what happened after the selling returned.

The sharp bounce we have seen in the Euro since the start of the year has taken it right into the sell zone of the previous wave.

It’s still early days, because short-term upside momentum remains strong and no monthly sell pivots have been confirmed.

But it is worth keeping an eye on because a large correction in the Euro could be enough to stop the rot in the US Dollar Index [TSV:DXY] and see a bounce from oversold levels.

Strock markets in general remain in limbo trying to work out the long-term effects of Trumps tariff policies.

I think making sweeping predictions about what comes next is a fool’s errand. I’d prefer to listen closely and be prepared to jump either way depending on the path prices take.

Regards,

Murray Dawes,

Editor, Retirement Trader

All advice is general advice and has not taken into account your personal circumstances.

Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.