As of June 27, 2025, banks’ housing loan (including priority sector loans) growth decelerated to 9.6 per cent y-o-y

Home loan growth has hit the slow lane, with prospective borrowers preferring to wait and watch in the current rate cut cycle to get the benefit of cheaper borrowing down the line.

These borrowers have perhaps gauged that they will be better off postponing borrowing by a few more months in their quest for softer interest rates and lower EMI outgo

The reason is that the Central bank is expected to reduce its signal (repo) rate in two tranches of 25 basis points by December 2025 and the same will get transmitted into lending rates of banks and housing finance companies (HFCs), translating into lower borrowing cost for new borrowers.

That prospective home loan borrowers are closely watching interest rates and taking borrowing calls accordingly is borne out by RBI data.

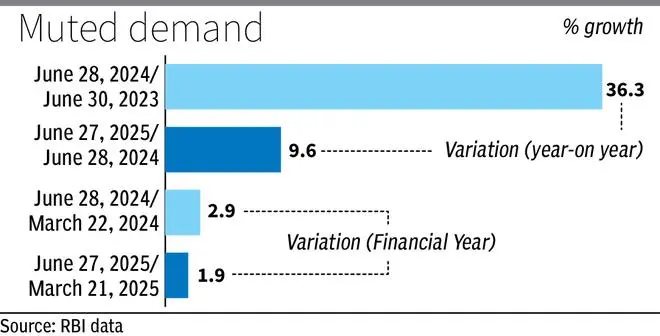

As of June 27, 2025, banks’ housing loan (including priority sector loans) growth decelerated to 9.6 per cent year-on-year (y-o-y) from 36.3 per cent y-o-y growth as of June 28, 2024. In FY26 so far (up to June 27, 2025), housing loan growth declined to 1.9 per cent from 2.9 per cent as at June 28, 202.4

Tribhuwan Adhikari, Managing Director & CEO, LIC Housing Finance Ltd,said:“We are right now in the middle of an interest rate cut cycle…And initially when RBI cut the rates by 100 basis points, we were very buoyed and happy and hoping for a big increase in demand.

“Unfortunately, at least at LICHFL, we have not seen that surge in demand…I believe many of the borrowers are waiting for this cycle to get completed and take complete benefit of the rate cuts,” he added.

He noted that borrowers may be taking into account the likelihood of further rate cuts. So, they may be waiting for the entire rate cut cycle to go through before taking a call.

“As far as new (home) loans are concerned, there is a slow down. This is quite surprising actually. I was surprised because when the repo rates went down by 100 basis points, I was pretty gung-ho, hopefully looking for a good demand in the market for housing loans,” he said.

“We were expecting a good boost but unfortunately that has not happened and it intrigues me. The only logical explanation I can give is people are smart. Probably they know that there are further rate cuts coming and are waiting it out, waiting for the cycle to get completed before taking a call (on borrowing),” Adhikari said.

The LICHFL chief expects acceleration in home loans from third quarter onwards, with loan growth climbing to double digits from single digits (3 per cent growth in disbursements) in the first quarter.

Published on August 2, 2025