The ASX has slipped heavily on Friday. Picture via Getty Images

- ASX smacked as Trump goes full tariff

- Banks, tech and health take a dive

- ResMed surged after smashing earnings

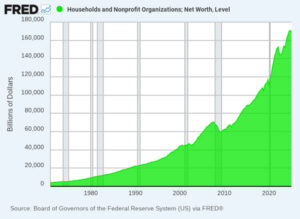

The ASX 200 was down by 0.75% at lunch time in the eastern states, with investors firmly in risk-off mode.

Only miners and utilities put up a fight. Everywhere else, it was a mess.

Health stocks were out of breath, tech looked like it had skipped leg day, and the big banks all sagged under the weight of global tariff fears.

It’s the kind of day where even the good names get dragged through the mud.

Commonwealth Bank (ASX:CBA), National Australia Bank (ASX:NAB),WiseTech Global (ASX:WTC) and Xero (ASX:XRO) all retreated.

This all followed another tariff tantrum from Donald Trump.

Canada just got hit with a jump from 25% to 35%, and new levies were slapped on Thailand, Cambodia, Taiwan and Switzerland.

Australia, somehow, managed to dodge the full swing, for now.

But with tariffs pushing up import prices, bets on US rate cuts just got punted out to October.

In the large caps space, conglomerate Washington H Soul Pattinson (ASX:SOL) nudged lower despite lifting its dividend again – its 27th annual increase, if you don’t mind.

Downer EDI (ASX:DOW) bagged a fresh $220 million defence deal, and ResMed (ASX:RMD) surged after smashing earnings expectations with a 37% jump in profit.

ResMed reckons it will keep growing even with Ozempic and its weight loss-pill mates nipping at the edges of the sleep apnoea market.

Gold producer Bellevue Gold (ASX:BGL) climbed after setting bullish production guidance of up to 150,000 ounces in FY26.

Meanwhile, Novonix (ASX:NVX) and Lithium Energy (ASX:LEL) have pulled the plug on the Axon Graphite IPO and the Mt Dromedary deal, citing weak market conditions.

Novonix is now reviewing next steps for Mt Dromedary, and its directors have resigned from the Axon board. Shares were flat.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for August 1 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| CYQ | Cycliq Group Ltd | 0.005 | 150% | 7,878,960 | $921,033 |

| DMG | Dragon Mountain Gold | 0.013 | 117% | 725,258 | $2,368,030 |

| 1AE | Aurora Energy Metals | 0.081 | 62% | 1,792,535 | $8,953,187 |

| LNR | Lanthanein Resources | 0.002 | 50% | 17,675,218 | $3,734,001 |

| RLG | Roolife Group Ltd | 0.004 | 33% | 70,872 | $4,778,344 |

| AON | Apollo Minerals Ltd | 0.009 | 29% | 150,000 | $6,499,198 |

| 4DX | 4Dmedical Limited | 0.300 | 25% | 9,364,191 | $111,729,714 |

| CTN | Catalina Resources | 0.005 | 25% | 200,000 | $9,704,076 |

| GSM | Golden State Mining | 0.010 | 25% | 252,061 | $2,234,965 |

| MEL | Metgasco Ltd | 0.003 | 25% | 125,337 | $3,674,173 |

| PIL | Peppermint Inv Ltd | 0.003 | 25% | 200,090 | $4,602,180 |

| QXR | Qx Resources Limited | 0.005 | 25% | 5,200,000 | $5,241,315 |

| VRC | Volt Resources Ltd | 0.005 | 25% | 4,040,000 | $18,739,398 |

| LKY | Locksleyresources | 0.130 | 24% | 26,437,175 | $19,250,000 |

| 8CO | 8Common Limited | 0.026 | 24% | 1,176,072 | $4,705,993 |

| SPG | Spc Global Holdings | 0.405 | 23% | 75,363 | $63,684,021 |

| IR1 | Irismetals | 0.110 | 22% | 522,009 | $16,016,344 |

| DTM | Dart Mining NL | 0.003 | 20% | 6,303,558 | $2,995,139 |

| RAN | Range International | 0.003 | 20% | 1,846,960 | $2,348,226 |

| GBE | Globe Metals &Mining | 0.052 | 18% | 685,582 | $30,564,732 |

| EXL | Elixinol Wellness | 0.020 | 18% | 340,750 | $3,913,254 |

| STM | Sunstone Metals Ltd | 0.020 | 18% | 23,846,808 | $104,874,083 |

| CCO | The Calmer Co Int | 0.004 | 17% | 143,000 | $9,034,060 |

| CHM | Chimeric Therapeutic | 0.004 | 17% | 768,284 | $9,747,370 |

| HPC | Thehydration | 0.015 | 15% | 116,666 | $5,600,412 |

WordPress Table

Dragon Mountain Gold (ASX:DMG) surged after revealing that it has repaid its October 2024 convertible loan and interest in full, using funds from a new loan provided by an unrelated major shareholder. The move clears the slate and gives DMG more flexibility for future capital raising, as well as assessing new or existing project opportunities.

Aurora Energy Metals (ASX:1AE) says Eagle Energy Metals, which holds an option over its Aurora Uranium Project (AUP) in Oregon, is planning to list on the Nasdaq via a SPAC merger with Spring Valley Acquisition Corp. II. If the deal goes through, Aurora will receive US$16 million in Eagle shares, with more to come via milestones and a 1% royalty on future uranium production.

Locksley Resources (ASX:LKY) has locked in a heavily oversubscribed $5.3 million raise at $0.095 a share, with strong backing from institutional investors led by Tribeca Investment Partners. The fresh funds will go into drilling high-grade antimony and rare earths at its Mojave project in California, progressing downstream processing in the US.

LKY says the raise is a big vote of confidence in its US critical minerals strategy, with more than a dozen new institutions joining the register. Settlement is expected around August 6, with the raise split across two tranches – one already approved, and one pending shareholder tick.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for August 1 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| PAB | Patrys Limited | 0.002 | -25% | 74,887 | $4,731,620 |

| ROG | Red Sky Energy. | 0.003 | -25% | 3,106,371 | $21,688,909 |

| SYR | Syrah Resources | 0.275 | -24% | 12,731,271 | $376,567,220 |

| SPX | Spenda Limited | 0.006 | -20% | 32 | $34,614,116 |

| 1TT | Thrive Tribe Tech | 0.008 | -20% | 153,010 | $1,015,864 |

| GGE | Grand Gulf Energy | 0.002 | -20% | 21,282,858 | $7,051,062 |

| KNG | Kingsland Minerals | 0.105 | -19% | 127,677 | $9,432,918 |

| OKJ | Oakajee Corp Ltd | 0.048 | -17% | 349,874 | $5,303,870 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 1,985,774 | $11,104,423 |

| ID8 | Identitii Limited | 0.005 | -17% | 890,791 | $4,668,081 |

| VEN | Vintage Energy | 0.005 | -17% | 2,587,531 | $12,521,482 |

| LSR | Lodestar Minerals | 0.016 | -16% | 728,056 | $7,554,219 |

| AIV | Activex Limited | 0.011 | -15% | 383,554 | $2,801,534 |

| BDM | Burgundy D Mines Ltd | 0.028 | -15% | 1,505,337 | $46,903,965 |

| YRL | Yandal Resources | 0.115 | -15% | 775,878 | $41,746,723 |

| GTR | Gti Energy Ltd | 0.003 | -14% | 6,150,000 | $13,029,292 |

| PLC | Premier1 Lithium Ltd | 0.006 | -14% | 330,372 | $2,576,424 |

| USL | Unico Silver Limited | 0.340 | -13% | 3,032,364 | $170,798,064 |

| OD6 | Od6Metalsltd | 0.021 | -13% | 577,267 | $3,851,231 |

| TX3 | Trinex Minerals Ltd | 0.110 | -12% | 516,223 | $5,835,180 |

| BEO | Beonic Ltd | 0.265 | -12% | 30,000 | $21,258,302 |

| MVP | Medical Developments | 0.540 | -11% | 71,639 | $68,721,578 |

WordPress Table

IN CASE YOU MISSED IT

Pure Hydrogen (ASX:PH2) looks to focus on battery electric and hydrogen fuel cell vehicles along with hydrogen equipment, proposing a name change to Pure One.

DY6 Metals (ASX:DY6) has welcomed Dr Moses Ndasi as in-country manager for Cameroon, bringing more than 20 years’ experience in minerals and mining throughout Africa with him.

DY6 has also promoted Troth Saindi to exploration manager for Africa, Geoffrey Banda to project geologist, Africa, and Corné Coetser will transition to senior exploration geologist.

HyTerra (ASX:HYT) has drilled the McCoy 1 well at the Nemaha hydrogen and helium project in Kansas to a total depth of 5562 feet, on time, within budget, with no safety incidents.

McCoy 1 will be converted to an appraisal well over the coming days with a workover rig to proactively monitor the well and evaluate flow test viability.

Arika Resources (ASX:ARI) has tapped geologist Steve Vallance as technical director, leveraging his 35 years’ experience in gold and nickel sulphide deposits. He most recently served as chief exploration geologist for Jubilee Mines, where he co-led discoveries that eventually led to a $3.3b acquisition by Xstrata Nickel.

Star Minerals (ASX:SMS) has advanced four separate permitting studies to the final draft stage, preparing to submit formal applications for flora and fauna, subterranean fauna, and hydrogeology and hydrology assessments and a geological and geotechnical report. With only a few permits left to obtain, SMS says its mining approval application is nearing completion.

At Stockhead, we tell it like it is. While DY6 Metals, HyTerra, Arika Resources and Star Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.