Locksley is cashed up to pursue antimony and rare earths drilling at the Mojave project in California after raising $5.3m in an oversubscribed placement. Pic: Getty Images

- $5.3 million raised at 9.5c a share in placement

- Oversubscribed with strong interest from institutional and professional investors

- Tribeca Investment Partners led raise with cornerstone investment

Special Report: A heavily oversubscribed $5.3 million capital raise has validated a US centred critical minerals strategy at the Mojave antimony and rare earths project.

Locksley Resources (ASX:LKY) will channel the fresh funding into a new drilling program at Mojave, targeting high-grade antimony and rare earths at the Californian asset.

The placement support was spearheaded by Tribeca Investment Partners, a globally recognised resources investment firm, which made a cornerstone investment in LKY during the raise.

Locksley chair Nathan Lude said the company was extremely pleased with the level of demand and quality of institutional participation in the placement.

“Having Tribeca cornerstone the raising is a strong endorsement of our strategy and team,” he said.

“In addition, we welcome more than a dozen new institutions to the Locksley register, providing us with a robust group of investors capable of supporting our forward looking growth strategy.

“This funding places us in a strong position to execute our exploration and downstream plans across the Mojave project and unlock the full value of our US based critical minerals portfolio.”

More from Locksley Resources: Poised to take advantage of US critical minerals boom from Mojave

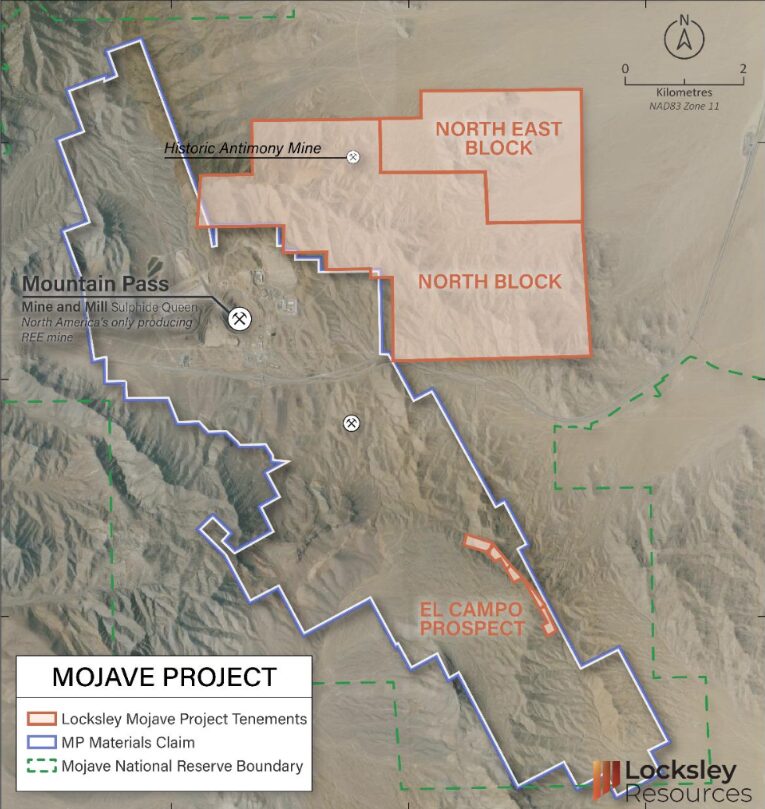

Mojave antimony and rare earths project

Funding from the latest raise will mostly go to exploration, permitting and downstream development for the Mojave project in California.

Mojave is directly next door to MP Materials’ Mountain Pass rare earths mine, recently subject to two hefty investments from the US Department of Defense and US tech giant Apple.

Mojave’s El Campo prospect lies directly along strike from Mountain Pass, while the North Block tenement directly abuts claims held by MP Materials.

LKY has also identified potential for antimony and silver in surface sampling, with results up to 46% Sb and 1022g/t Ag.

Locksley intends to take advantage of looming rare earth and antimony supply shortages in North America after China moved to restrict exports of the critical minerals in recent years.

This article was developed in collaboration with Locksley Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.