Chinese electric vehicle (EV) companies have reported their July 2025 deliveries. Here are the key takeaways from their reports.

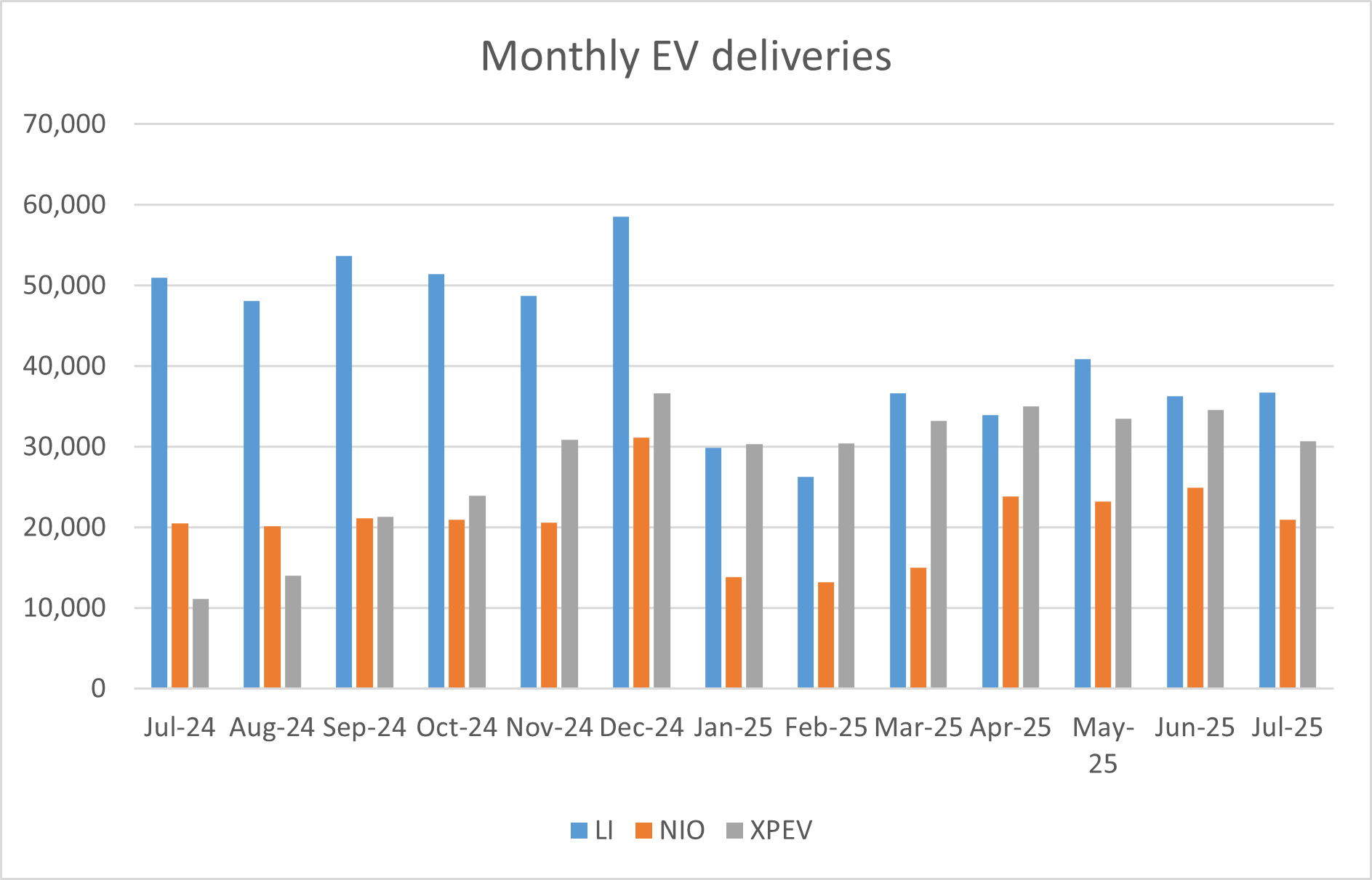

NIO delivered 21,017 vehicles in July. While its deliveries rose 2.5% year-over-year, they fell 15.7% on a monthly basis. Looking at the breakup, NIO delivered 12,675 vehicles from its premium eponymous brands while deliveries of its family-oriented ONVO brand were 5,976. The remaining 2,366 deliveries were from its Firefly brand.

NIO’s cumulative EV deliveries top 800,000

In the first seven months of 2025, NIO delivered 135,167 vehicles, representing a 25.2% YoY increase. Cumulative EV deliveries reached 806,731 by the end of July, as the company surpassed the milestone of 800,000 units.

NIO also announced the official launch and immediate commencement of deliveries for its ONVO L90, which helped support sentiments. The model starts at RMB 265,800 (around $36,850) and is expected to spur NIO’s EV shipments in the back half of the year.

Xpeng Motors reported record EV deliveries

Xpeng Motors delivered 36,717 EVs in July, 229% higher YoY and a new monthly record. Moreover, July marked the ninth consecutive month with deliveries exceeding 30,000 units. The company delivered a total of 233,906 EVs in the first seven months of the year, a 270% increase compared to the same period in 2024. Xpeng’s cumulative deliveries rose to 824,307 at the end of July as it also surpassed the milestone of 800,000 units.

Xpeng Motors is believed to have among the most advanced autonomous driving capabilities among Chinese EV companies. The company’s focus on its XNGP advanced driver-assistance system is gaining traction, achieving an 86% monthly active user penetration rate in urban driving.

Leapmotor’s deliveries rise above 50,000

Leapmotor celebrated a new milestone in July, delivering a record 50,129 vehicles, 127% higher than the corresponding month last year. This marks the first time the company has surpassed the 50,000-unit monthly delivery mark and represents its third consecutive month of setting new records. Year-to-date, Leapmotor has delivered 271,793 vehicles, an almost 150% YoY increase.

Zeekr’s deliveries rise 19.7% YoY

The Zeekr Group, which includes both Zeekr and Lynk & Co brands, delivered 44,193 vehicles in July, a YoY rise of 19.7%. Specifically, the Zeekr brand delivered 16,977 vehicles while the remaining deliveries were for Lynk.

Li Auto delivered 30,731 vehicles in July, significantly below the 51,000 that it delivered in the corresponding month last year. The company’s EV models haven’t received the same kind of reception as its hybrid models, which has taken a toll on its sales. The company launched its Li i8 electric SUV earlier this week, which might help it gain share in the hugely competitive Chinese EV market.

BYD lost momentum in July

BYD also lost momentum last month as sales fell 10.6% as compared to June, even as deliveries rose slightly YoY. Looking at the breakup, BEV (battery electric vehicle) sales surged by 36.8% YoY, reaching 177,887 units. However, this marked the first month-over-month decline in passenger BEV sales since February.

Sales of PHEVs (plug-in hybrid vehicles) showed a significant slowdown, with deliveries falling 22.6% YoY to 163,143 units. This marks the fourth consecutive month of declining PHEV sales for BYD.

BYD’s global sales also fell 10.3% month-on-month to 80,737 units in July. Prior to that, the company’s global sales hit record highs for seven consecutive months.

Despite the July slowdown, BYD’s year-to-date performance remains robust, with 2,490,250 NEVs (new energy vehicles) sold from January to July, a 27.35% increase compared to the same period in 2024.

BYD slashed EV prices in May

The sharp rise in first-half deliveries was in part due to the massive price cuts that BYD announced in May to spur sales. The price cuts, which lasted until June, were quite aggressive, and the company slashed the price of its Seagull hatchback by 20%. The model, which is the cheapest from BYD, would now cost just about 55,800 yuan (around $7,780). The biggest cut was for the Seal dual-motor hybrid sedan, whose price was slashed by 34%.

BYD might miss its ambitious target of selling 5.5 million vehicles in 2025. The company has sold fewer than 2.5 million vehicles in the first seven months of the year and would need to sell more than 3 million units in the remaining 5 months to meet the goal. It looks like a tall ask to reach that goal; the company would need to deliver around 602,000 vehicles every month on average in these months, which, for context, is significantly higher than the all-time high deliveries of 515,000 in December 2024

BYD Looks on Track to Become the Biggest EV Seller in 2025

BYD already sells more cars than Tesla and looks set to grab the title of biggest BEV seller in 2025, considering it outsold the Elon Musk-run company in the first half of the year.

Chinese EV companies offer models at very competitive prices, which has helped them grab market share in markets outside China, particularly in Europe, where names like BYD are giving Tesla a tough fight despite having a much lower vintage in that market.

Musk has been all praise for Chinese EV companies and the country’s EV ecosystem. During Tesla’s Q4 2023 earnings call last year, he said, “Frankly, I think, if there are no trade barriers established, they will pretty much demolish most other companies in the world.”

He added, “The Chinese car companies are the most competitive car companies in the world. So, I think they will have significant success outside of China depending on what kind of tariffs or trade barriers are established.”