Yes, really. You don’t need large sums to start investing in UK property. You really can start with a deposit of only 5%.

Buying an investment property in the UK, a low-risk and steady market is much more affordable than you might think.

This part-conversion development has a low entry point with lots of potential for rental and capital growth.

The charming Derbyshire town of Chesterfield, a short distance from the cities of Sheffield, Derby and Nottingham, has a shortfall of quality rental property so there is high demand.

With a low initial deposit of just 5%, you pay the balance of the deposit, to 35%, by way of 30 monthly payments.

EDIT 29/07/2025 Update – half of the units have already been reserved so you can see this is a popular oportunity. If you are interested, do not delay!

Quick facts:

- One bed apartments £164,995

- Studios £149,950 (two only)

- Two bed apartments -£184,995 (six only)

- Prime town centre location, right on the high street

- Initial yields of 6%

- Growth of 15-20% predicted over the next three years

- 999 year lease

- Completion Q4 2027

- Initial deposit of only 5%

- Easy payment options

- Exchange of contracts takes place soon after the intial deposit payment

Why Chesterfield?

Chesterfield has real character and history. Located at the edge of the beautiful Peak District this large Derbyshire town may not be the best-known place but it is on the up.

It is benefitting from substantial regeneration, with a town centre masterplan, and both road and rail improvements. Government studies show a positive outlook for the local economy and a growing population. And a growing population needs places to live.

This is a very affordable place to invest as house prices are currently lower than the national average, especially compared to nearby cities like Sheffield or Derby. Many people working in these cities are looking at moving a little further out for better value for money and a quieter life.

You can start at a lower price and get more for your money, with a growing pool of potential tenants.

Chesterfield is close to the M1 motorway and has direct rail services to Sheffield, Nottingham, Leeds, and even London. The train journey to Sheffield takes just 15 minutes making it perfect for an easy commute. Residents also travel to Derby and Nottingham for work.

The town has an undersupply of rental property which is why the developer is building here. They, and we, do a great amount of research before offering developments to clients for investment. This isn’t anything flashy, but it’s a low-risk, low-priced, secure and solid addition to your future plans.

How to buy

It is easier than you think. You need an initial deposit of just 5% of the purchase price plus legal fees of £1,500. You then make monthly payments for 30 months to build up to a full deposit of 35%.

At that time, the development will have completed and you can take out a mortgage for the remaining 65%. Help will be on hand for that. At completion Stamp Duty is also payable as is standard for UK property purchases.

All costs are fully disclosed and explained to you before you go ahead. Both the developer and I are around to answer any ongoing questions although you will receive regular updates during the build process.

What are the actual costs?

This is an example of what you could expect to pay although it will obviously vary depending on actual purchase price and reservation date

Purchase price £164,995 1 bed apartment

Reservation deposit £8,249.75 5%

Initial legal fees £1,500 payable at time of deposit

30 monthly payments of £1,649.95 @21/07/25 that is AED 8,166/SAR8,338

After 30 months, at completion, you will have paid a deposit of 35% so only need to pay the balance of £107,246.

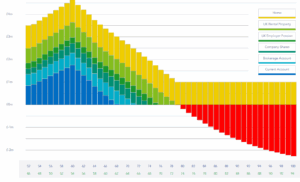

At time of writing, an expat mortgage could have an interest rate of 5.5%. For a repayment mortgage over 20 years, the monthly repayment would be just £747.86. Over 25 years, you would pay only £666.26 per month. Either way, less than you had been paying for the deposit so you are only paying a higher amount for two and a half years.

For one of the studios, the initial deposit would be only £7,499.75, with 30 monthly payments of £1,499.95.

Fun fact

Chesterfield is famous for the Crooked Spire of St Mary and All Saints Church, which leans and twists dramatically.

Chesterfield is famous for the Crooked Spire of St Mary and All Saints Church, which leans and twists dramatically.

Centuries of the wood warping caused the distinctive twist and it now leans nearly nine feet off-centre and twists about 45 degrees

This is why the local football team, Chesterfield FC, is known as The Spireites.

If you want a steady, long-term investment that will provide you with an income, this is what you want. You don’t need to wait months, or even years, to save up a large deposit. You won’t have any concerns about the market as UK property volatility is minimal. High legal protection and this project is already fully funded which means no risk to you.

How do I find out more?

Get in touch! Click on this link to send me an email: keren@holbornassets.com or use the contact form at the end of this article

I have brochures, pricing schedules, full financial details – all the information that you need to know.

We can calculate the amount of Stamp Duty payable on purchase based on your personal situation, the potential mortgage costs and more.

We even arrange the life insurance and wills to protect your and the property.

Let’s have a relaxed and friendly chat without any obligation. All initial meetings are over Zoom for maximum convenience.

To arrange a discussion about any aspect of your personal financial planning, please email me at keren@holbornassets.com

Expert, qualified, professional advice on a range of issues including general financial planning, life and critical illness cover, investments and UK pensions, wills and inheritance tax planning, UK tax, offshore banking, citizenship programmes, currency transfers and more.

I write articles such as this one as part of the holistic personal financial planning service and that I provide to expats, and the general consumer, financial and legal information that I provide in The National newspaper, other media, and on the Facebook group British Expats Dubai.

I write articles such as this one as part of the holistic personal financial planning service and that I provide to expats, and the general consumer, financial and legal information that I provide in The National newspaper, other media, and on the Facebook group British Expats Dubai.

Serious topics with relaxed and friendly conversations.

Useful related articles:

UK tax returns. A low-cost service

UK property investment. 10 reasons why it make sense

UK property options – latest info

Invest in Blackpool. The Vegas of the North of England!

NOTE. All information on this website is mine and must not be copied or reused without permission. ©Keren Bobker