Global Macro and Rates

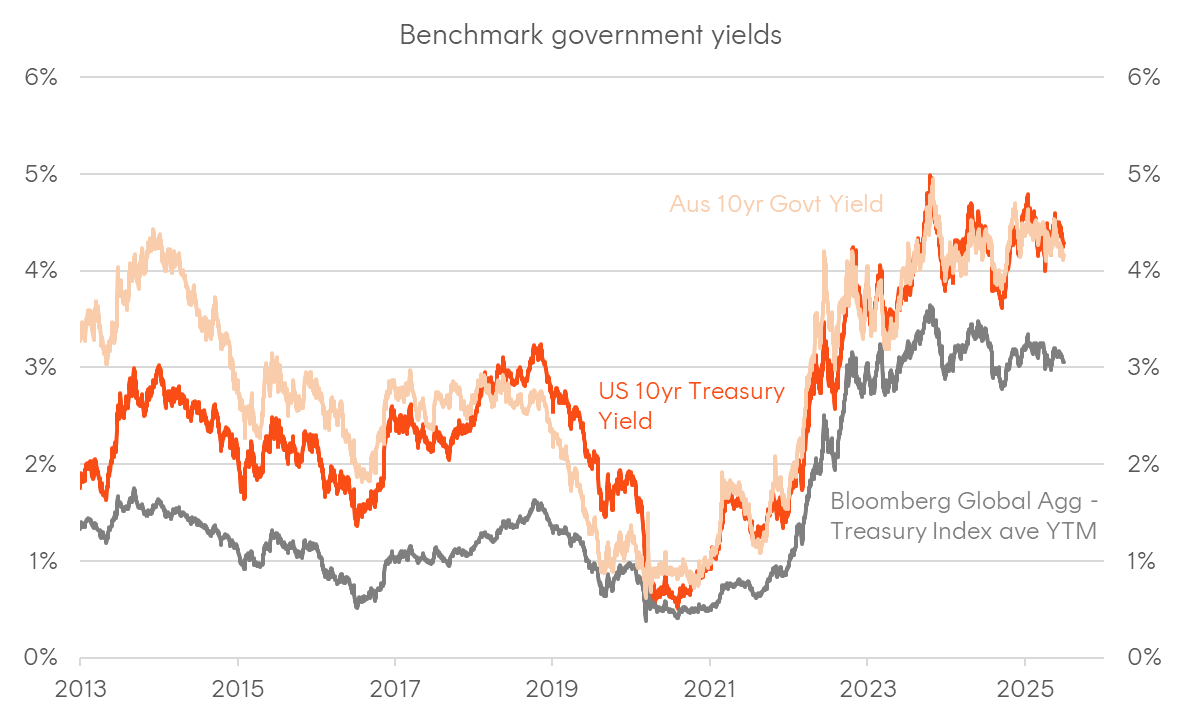

The second quarter of 2025 opened with heightened volatility and rising global trade uncertainty, as the US administration imposed sweeping new tariffs on its trading partners. Market conditions later stabilised into the Northern Hemisphere summer, but not before sharp gyrations across asset classes. The Bloomberg Global Treasury Index ended the quarter with a modest 13 basis point decline in yield, reflecting a general easing bias despite considerable swings in global rates markets. Much of the initial turbulence was triggered by the announcement of “Liberation Day” – a policy shift that raised the effective tariff rate on US imports from around 3% to nearly 20%, well above market expectations. The move sparked the sharpest equity sell-off in five years and significant volatility in bonds. In response, the Trump administration made several concessions, including delaying the rollout of reciprocal tariffs and significantly scaling back the measures targeting Chinese imports.

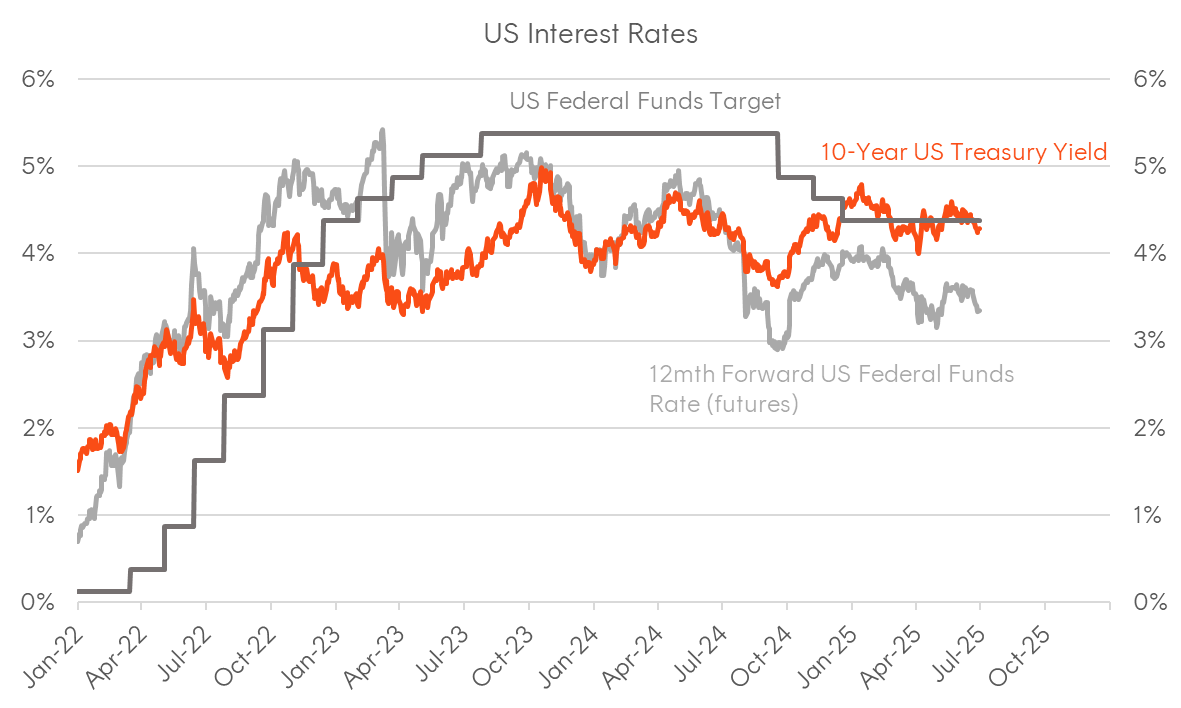

The US 10-year Treasury yield ended the quarter little changed but traded in a 60-basis point range, reflecting heightened volatility in global rates markets during April and May. A broad-based deleveraging event in fixed income, triggered by concerns about the long-term implications of US trade policy, added to the turbulence, with renewed debate over the dollar’s reserve currency status and Treasuries’ role as core reserve assets emerging. Reports of tentative repatriation flows by sovereign investors further unsettled the long end. Fiscal concerns also came into sharper focus following the passage of the “One Big Beautiful Bill Act” (OBBBA), while the paring back of recession expectations following the tariff rollback also weighed on Treasuries at the margin. These developments, along with a sharp sell-off in long-term Japanese Government Bonds (JGBs) amid expectations of tighter BoJ policy, drove a pronounced steepening in global curves. In the US, the spread between 30-year and 5-year Treasury yields widened by 35 basis points over the quarter, with the long end acutely sensitive to issuance and shifting fiscal sentiment. However, yields and volatility moderated into quarter-end, as the 10-year yield drifted back to 4.36%, aided by the summer lull and growing speculation of a more dovish post-Powell Fed, particularly amid signs of labour market softness.

Global central bank policy retained an easing bias on balance during the quarter. The US Federal Reserve held the federal funds rate steady at 4.25–4.50% but adopted a more hawkish tone in the June FOMC, lifting its 2025 core inflation forecast to 3.1% (from 2.8% previously) and trimming growth expectations to 1.4% (from 1.7% previously), as it signalled a willingness to keep policy restrictive amid ongoing tariff-related inflation uncertainty. In contrast, the European Central Bank delivered a 25-basis point rate cut in June, citing improved inflation dynamics and weak growth, with German 10-year bund yields falling 13 basis points. The Bank of England struck a more cautious tone, cutting rates in May but holding in June amid soft GDP and a loosening labour market. Elsewhere, the Bank of Canada paused its cutting cycle at 2.75%, while the Bank of Japan kept its policy rate at 0.50% and flagged a halving of bond purchases from the next fiscal year, as it inches towards policy normalisation.

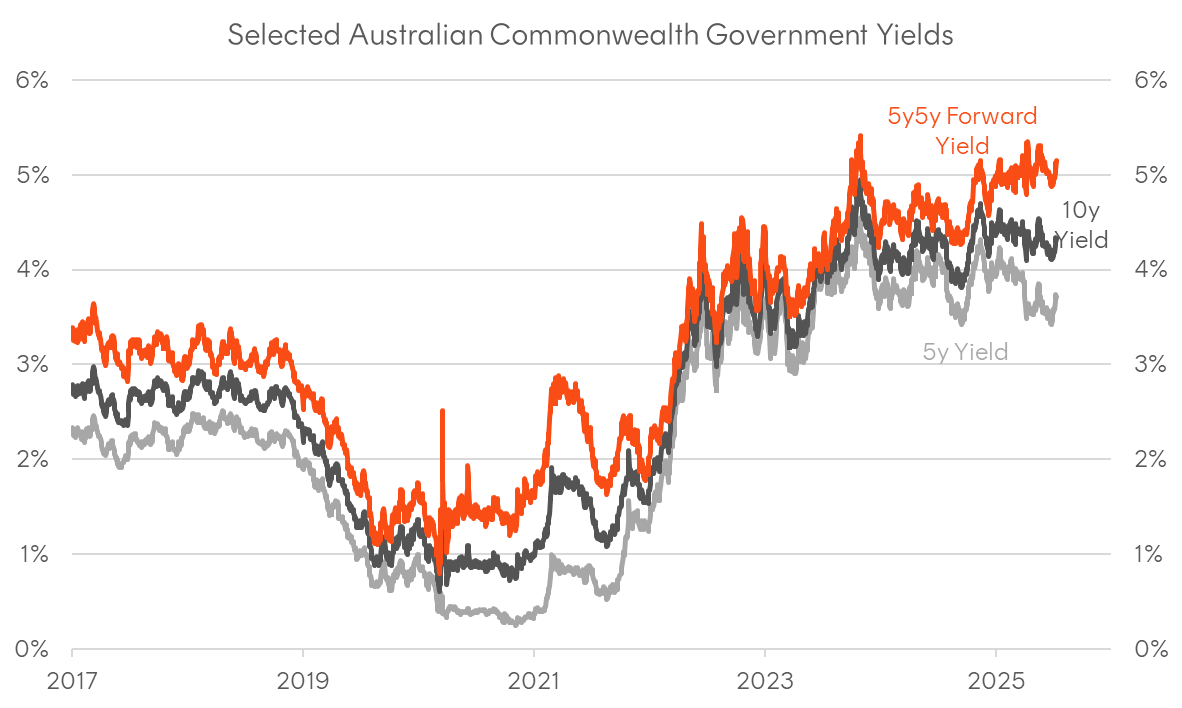

Domestic Macro and Rates

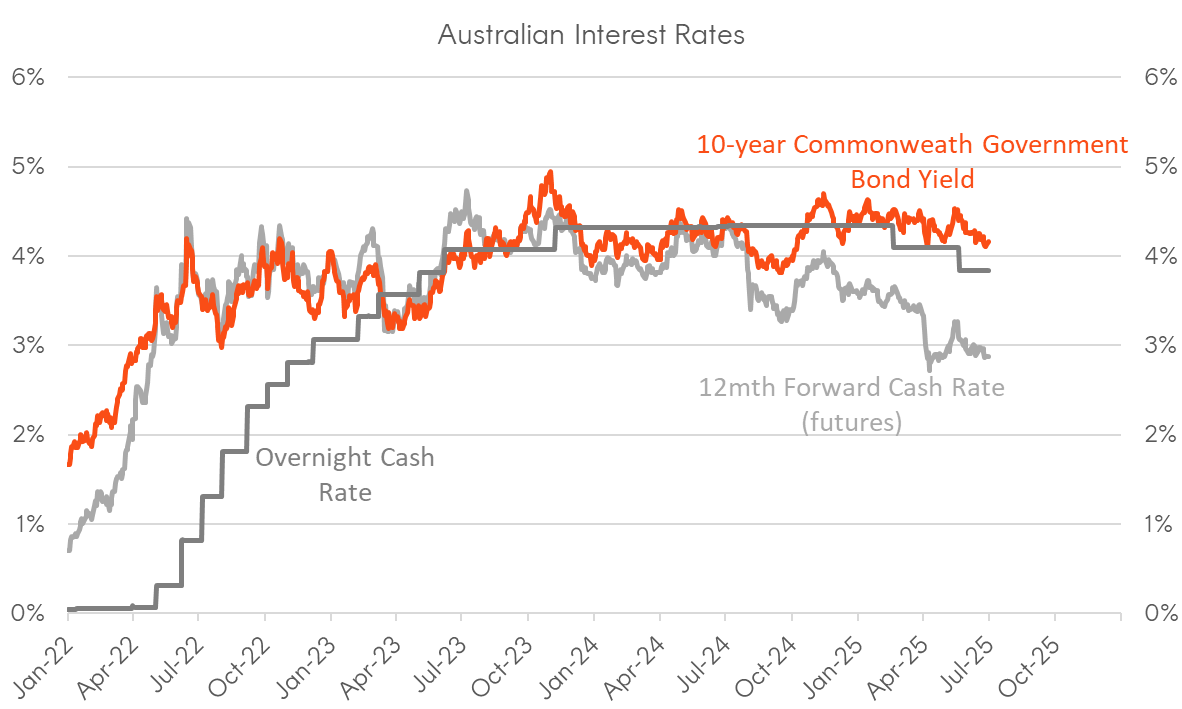

In Q2 2025, Australian government bond yields fell across the curve in response to the RBA’s dovish monetary stance and continued moderation in domestic inflation data. Following the previous quarter, the yield curve again moved in a bull steepening fashion, with 3-year yields falling by 44 basis points and 10-year yields down by 22 basis points. The sharp decline in yields reflected not only actual rate cuts, but also market expectations of further RBA easing toward the end of the year.

In May, the RBA delivered a second consecutive 25 basis point rate cut, lowering the cash rate to 3.85%. In its Statement on Monetary Policy, the Bank struck a dovish tone, noting that inflation pressures had continued to ease, with both headline and trimmed mean inflation falling within the 2–3% target range. The accompanying forecasts also showed downward revisions to activity, employment, and inflation, reinforcing the case for further easing. While the unemployment rate remained steady at 4.1%, softer-than-expected household consumption earlier in the year, in addition to rising global risks amid trade uncertainty, contributed to a weaker near-term growth outlook.

Global Credit

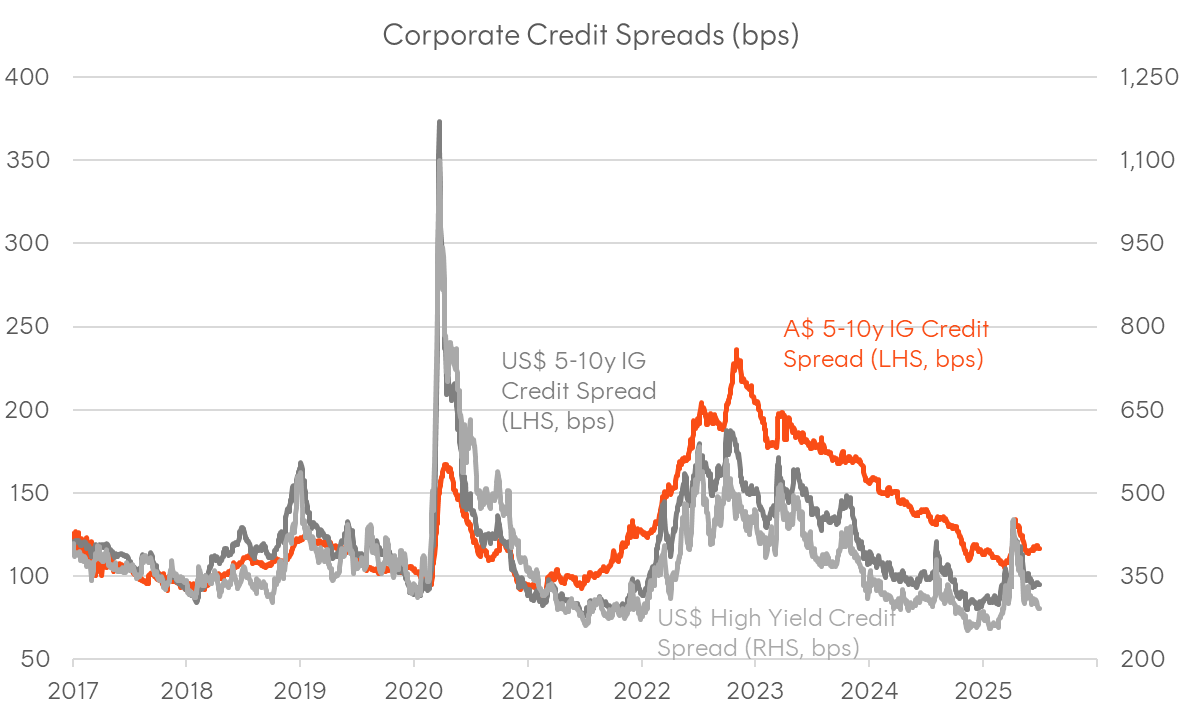

After an extended period of calm and historically tight spreads, global credit markets were thrown into turmoil in early April. Building on the trade concerns of Q1, the announcement of “reciprocal tariffs” and a collapse of key round of US-China trade negotiations triggered a severe risk-off shock causing virtually all asset classes to sell off in unison. This risk-off wave drove a sharp widening in credit spreads globally, as uncertainty around growth and corporate earnings surged, leading to an immediate and substantial de-risking across portfolios.

US credit markets came under pressure in early April, with investment-grade spreads widening over 30 basis points and high-yield spreads surging by over 100 basis points in a matter of days. The spike in risk premia was driven by a sudden escalation in US–China trade tensions and growing concerns around earnings and growth. As anxiety peaked, primary issuance virtually halted as issuers and investors reassessed the outlook. However, sentiment began to recover by late April, aided by a partial rollback of tariff measures and better-than-expected first-quarter corporate earnings. With worst-case recession fears receding and new-issue supply remaining subdued, credit markets staged a powerful rally through the remainder of the quarter. By the end of June, investment-grade spreads had not only retraced the April widening but ended the quarter tighter, while high-yield spreads erased most of their earlier move. The quarter marked a full round trip in sentiment — from risk-off capitulation to renewed risk appetite.

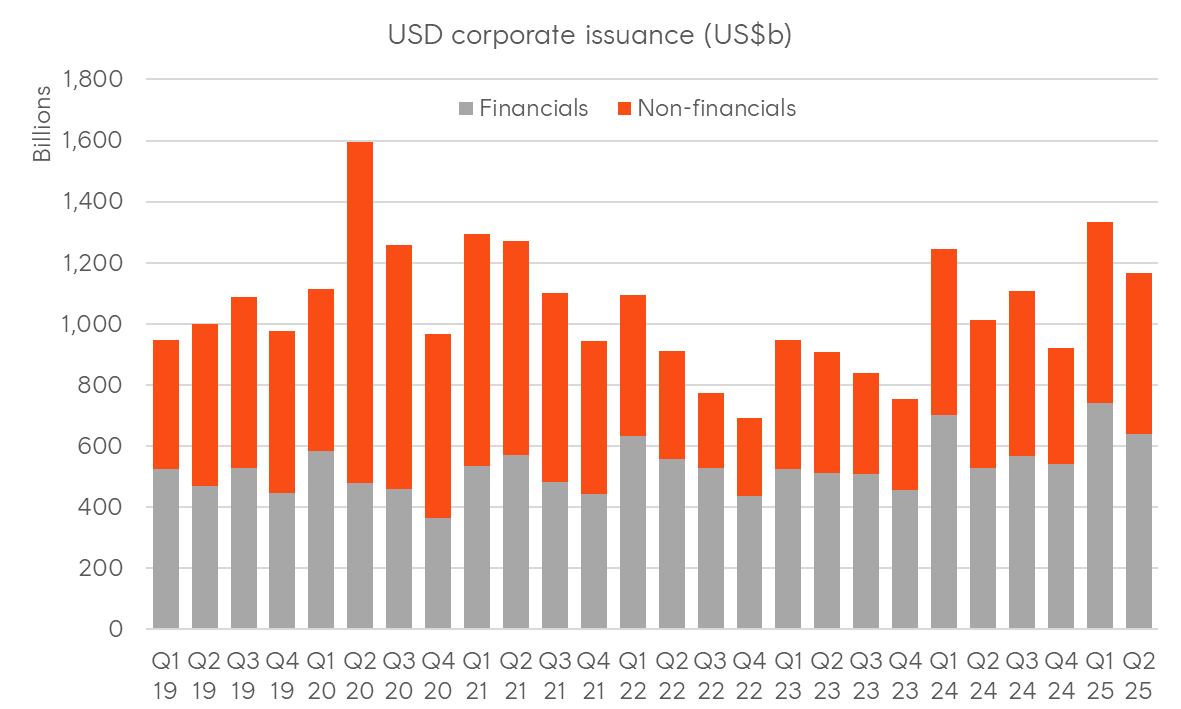

In the U.S., issuers who had front-loaded funding needs into a record first quarter continued to access the market in Q2. Borrowers seized on the rallying market to lock in attractive funding rates, particularly in the investment-grade space. This dynamic, where strong demand met relatively light supply, helped spreads tighten in late Q2 despite lingering concerns about fundamental growth.

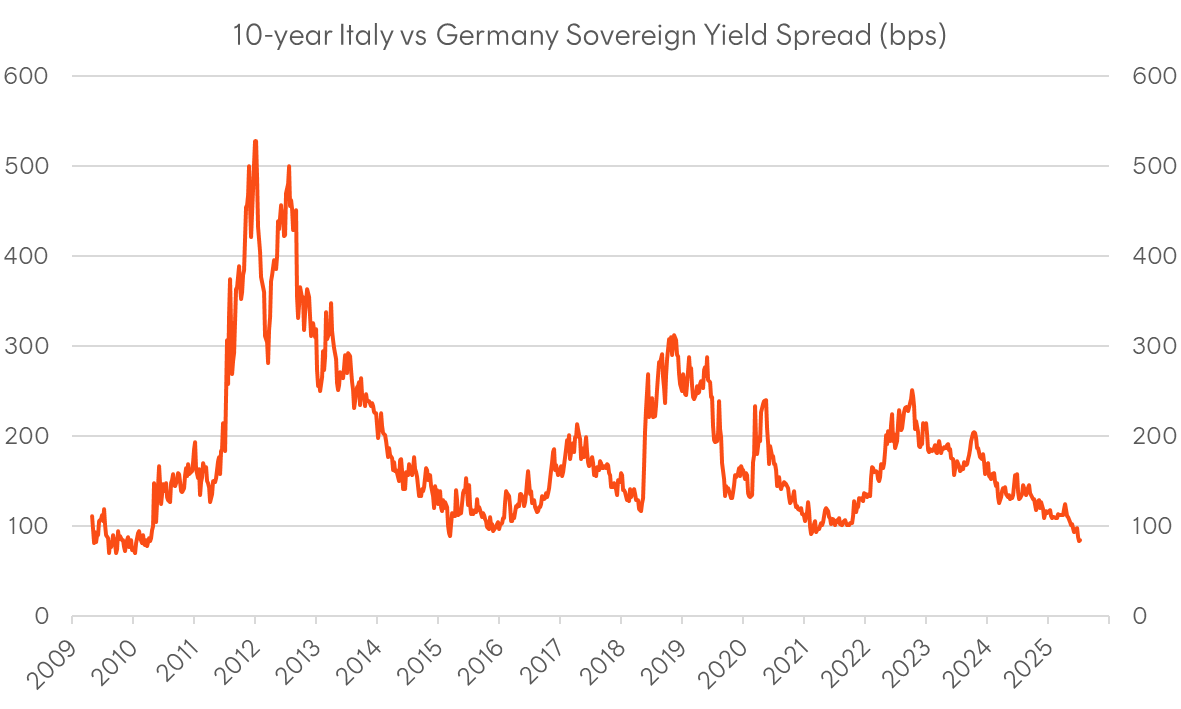

European credit markets experienced a similar, though more measured, bout of volatility. While less directly exposed to the US–China trade dispute, European IG spreads widened in sympathy with the global risk-off move. Support came from the European Central Bank’s reaffirmed dovish stance and accelerating rate-cut cycle, as falling euro-area inflation offset the prior quarter’s rise in core yields driven by Germany’s expansive fiscal policy. A notable development was the continued tightening in peripheral sovereign spreads, with Italian 10-year spreads compressing to their tightest level versus Bunds since the global financial crisis. EUR IG spreads ended Q2 roughly flat to modestly tighter compared to Q1. Primary issuance mirrored the swings in sentiment, with a quiet April followed by a burst of opportunistic funding activity in May and June as conditions improved.

Domestic Credit

Australian credit markets were not immune to the global risk-off shock in April, though the subsequent recovery was slightly more tentative than that seen in the US. Spreads followed global markets wider at the start of the quarter, with 5–10-year Australian investment-grade spreads widening from +113 basis points over government to a peak of +134 basis points by mid-April. This move was driven primarily by imported volatility from global investors de-risking portfolios, rather than specific domestic credit concerns. As global volatility subsided through May and June, Australian spreads gradually compressed. By quarter-end, the market had nearly completed its own round trip and Australian 5-10yr IG spreads finished Q2 little changed.

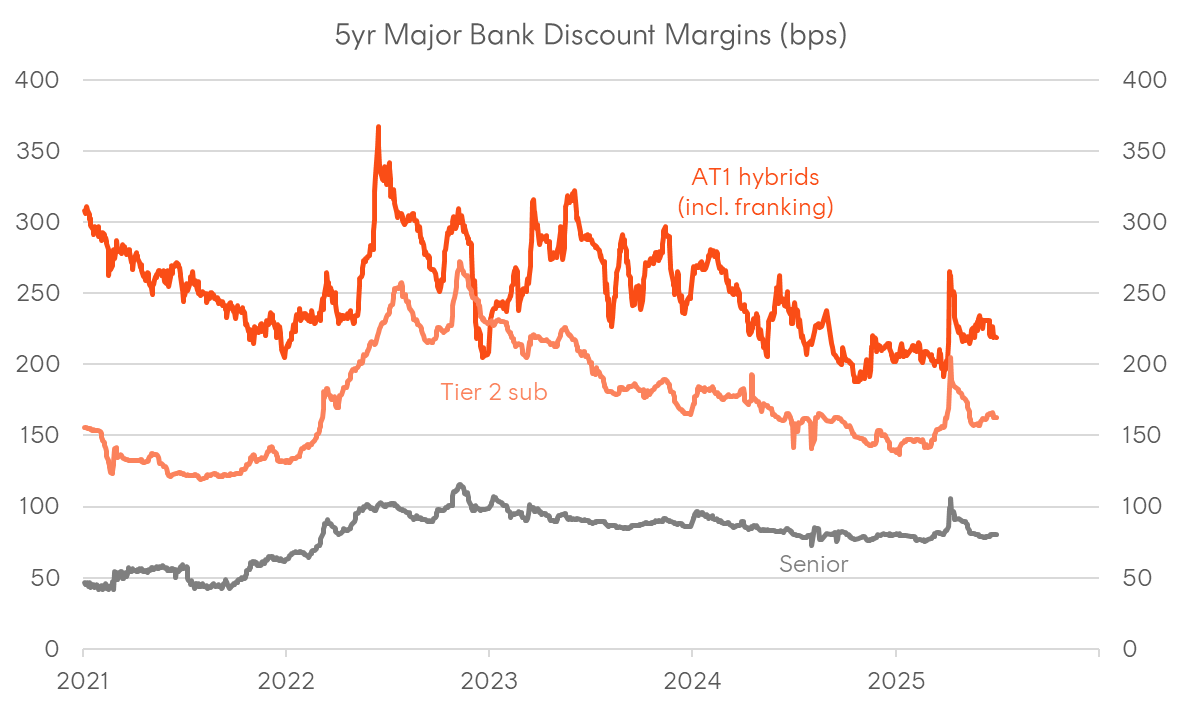

Spreads across the Australian bank capital structure also reflected global credit developments, with senior spreads on major bank FRNs ending largely unchanged after widening as much as 20bps in April. Further down the capital structure, Tier 2 spreads ended 5bps wider, while bank hybrids tightened 15bps over the quarter after gapping as much as 60bps wider on the Liberation Day shock.

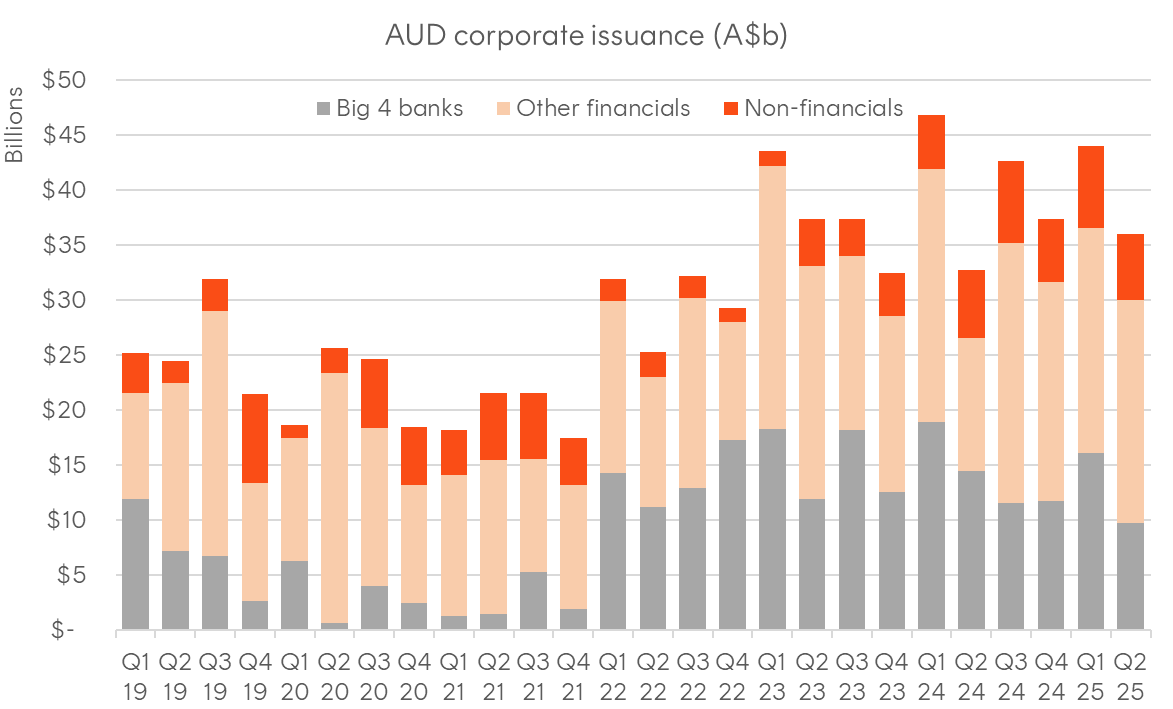

The Australian primary market was active in the second quarter after a brief pause during April’s volatility, reflecting a more cautious stance from issuers. The securitisation market was a standout performer. After a blockbuster March, the market froze in April, with the two deals that did price requiring a significant ‘volatility premium’. As conditions improved, a flood of issuance returned in May and June printing a total of 19 deals. Prime Non-bank RMBS margins compressed back towards the +105-110 basis points discount margin level by the end of June. Broader issuance was heavily concentrated in the latter two months of the quarter. The major banks were opportunistic, issuing approximately $9.75 billion, while non-financial corporate issuance, in contrast, remained tentative, with volumes falling to just $5.9 billion for the quarter, down from $7.4 billion in Q1.

Outlook

Despite an abundance of headlines – from a re-escalation in trade tensions to broader geopolitical uncertainty – the macro narrative remains surprisingly calm, with volatility declining and risk sentiment resilient. Beneath the surface, however, important signals are starting to emerge in the US labour market, which will be the ultimate arbiter of this cycle, and by extension, for the direction of global bond yields.

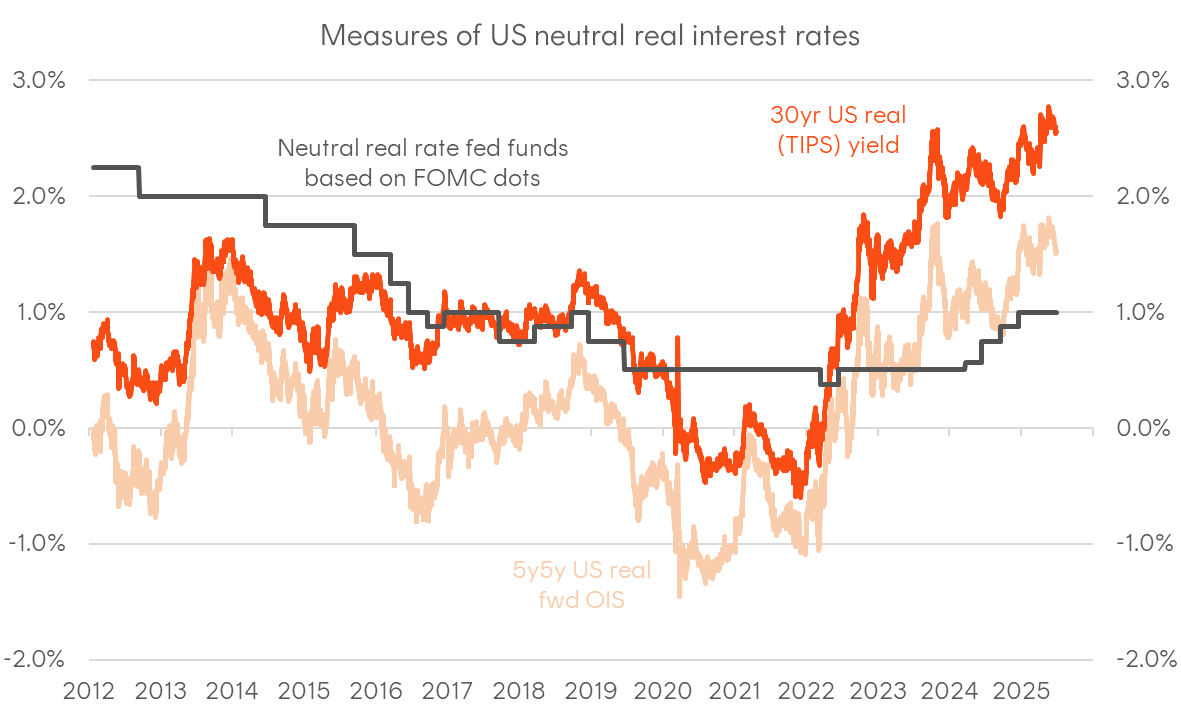

Although markets have shrugged off many of this year’s geopolitical and policy shifts and relegated the prospects of a US recession to a tail risk, labour market data in the US is steadily weakening. Public sector hiring has masked the deterioration in private employment, and multiple indicators – from job openings to private payrolls growth from both the BLS and ADP – now suggest that slack is building. If this softening continues, the Fed will face mounting pressure to cut, regardless of the inflation narrative or tariff pass-through effects. As a result, we believe that real yields are likely to trend lower over the medium term, particularly given the growing disconnect between restrictive policy settings and declining labour market momentum.

Closer to home, the RBA surprised markets by holding rates steady in July despite widespread expectations of a cut. While this decision has paused the easing cycle, we don’t believe it has derailed it. The RBA remains data dependent, and the upcoming Q2 CPI print is likely to confirm that trimmed mean inflation is drifting towards the midpoint of the Bank’s 2-3% target. If so, the RBA should have a clear green light to resume cuts and bring the cash rate closer to a neutral setting, which we estimate to be around 3%. Furthermore, risks to the cash rate outlook remain skewed to the downside, due to weak global growth signals from the US and China.

Against this backdrop, high grade fixed income – particularly longer-term government and government-related bonds – appears compelling. Measures of risk premia for duration are attractive, whether that’s the level of real yields, the steepness of the yield curve, or academic estimates of the term premium. This is especially so against a backdrop where global equities are once again trading at elevated valuations, and market breadth – especially in both US and Australian share markets – is narrowing. The renewed resurgence of megacap stocks in US equities, along with CBA maintaining its position as the world’s most expensive bank (by price-book), combined with current trends in investor sentiment and ongoing trade and growth risks, may increase the vulnerabilities of risk assets to potential negative developments. This increases the appeal of high-quality bonds, not just as a source of income, but as genuine portfolio diversifiers.

Figure 1: Benchmark government yields; Source: Bloomberg

Figure 2: US interest rates; Sources: Bloomberg, Fed

Figure 3: Australian interest rates; Sources: Bloomberg, RBA

Figure 4: Corporate credit spreads (OAS, bps); Source: Bloomberg

Figure 5: Italian 10yr spreads vs Germany; Source: Bloomberg

Figure 6: Australian bank discount margins (bps); Sources: Westpac, Betashares, Bloomberg, ASX

Figure 7: USD corporate issuance; Source: Bloomberg

Figure 8: AUD corporate issuance; Source: Bloomberg

Figure 9: Measures of US neutral interest rates; Sources: Bloomberg, Fed

Figure 10: Selected Australian Commonwealth Government Yields; Source: Bloomberg