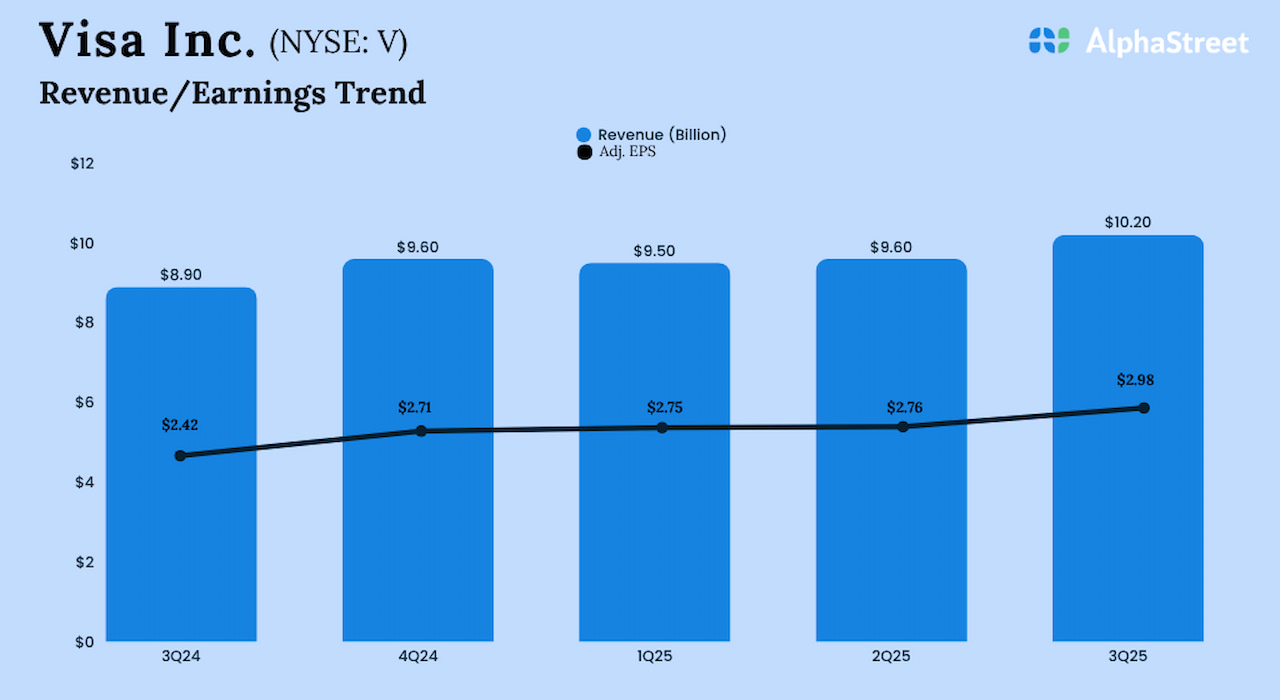

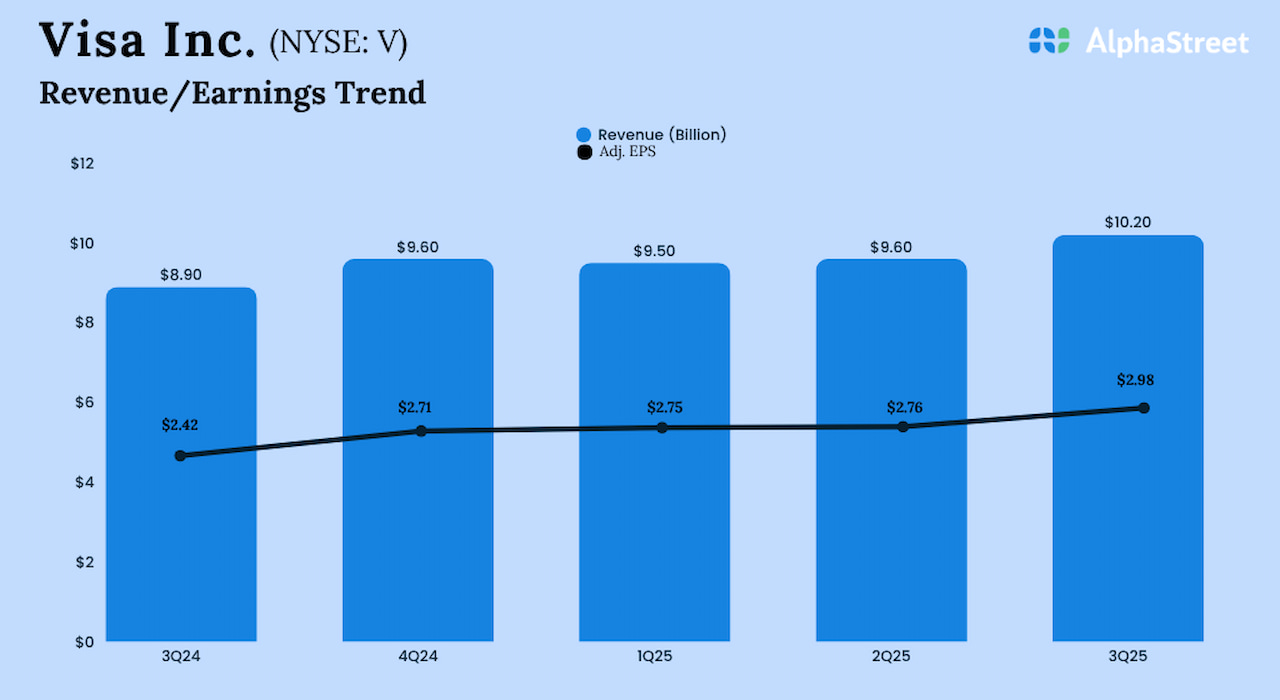

Credit card giant Visa, Inc. (NYSE: V) reported double-digit growth in revenue and adjusted earnings for the third quarter of fiscal 2025.

Third-quarter revenue grew 14% annually to $10.2 billion, aided by an increase in payments volume, cross-border volume, and processed transactions.

Driven by the strong top-line growth, adjusted earnings climbed 23% from last year to $2.98 per share in Q3. On a reported basis, net income increased 8% to $5.3 billion, and earnings per share grew 12% to 2.69.

“Looking ahead, our continued focus on innovation and product development in dynamic areas like AI and stablecoins is helping to shape the future of commerce while delivering sustainable, long-term value for our shareholders,” said Ryan McInerney, Chief Executive Officer, Visa.

During the quarter, the company repurchased around 14 million shares of its stock at an average cost of $349.24 per share, for $4.8 billion. The board declared a quarterly cash dividend of $0.590 per share, payable on September 2, 2025, to all holders of record as of August 12, 2025.