The F-word is usually unhelpful. Especially in investment strategy. But sometimes you’ve just got to call a spade a spade. So…President Trump is a fascist.

The F-word is usually unhelpful in political discourse. Let alone investment strategy.

But sometimes you’ve just got to call a spade a spade. Especially in the resources sector. It is full of government intervention already.

But President Trump has only made things worse. And so we’ll call him out: President Trump is a fascist.

Only in the narrow sense of economic policy, of course…

I don’t mean the political ideology. He seems too busy enjoying enforcing election integrity to be a proper fascist. And he respects the power of the Supreme Court…for now.

Benito Mussolini explained what I mean. And he would know: ‘Fascism should more properly be called corporatism because it is the merger of state and corporate power.’

That’s precisely what Trump has been up to lately. Merging the powers of state and corporations. Especially in the resources sector.

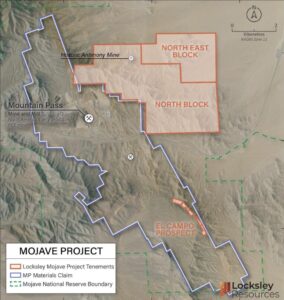

His deal to invest government money into listed rare earth mining company MP Materials is just the most blatant example. ASX listed company Lynas has some interesting connections to the US Department of Defence too.

Tariffs on copper were based on a ‘national security assessment.’ Trump is allowing more mining and more carbon emissions because he puts America First. And the trade deal with the EU is designed to replace Russian energy sales with American oil and gas.

All this is about the state and US corporations working together to Make America Great Again. Aligning big companies with geopolitical goals is classic fascist economic policy.

Nothing tastes as bitter as your own medicine

Like any good fascist, in the economic sense, Trump’s best argument is that someone else did it first. He’s only fighting back…

The Chinese have been using state sponsored enterprises for many years now. And you’ve probably heard about how such companies undercut their Western competitors. Sometimes by means of slave labour. Usually by means of what Doomberg calls ‘Geopollutical Warfare.’ Lax environmental standards allow Chinese industry to dominate.

But what you might not know is that China also has a habit of pushing down the price of globally traded resources like nickel. Especially strategically sensitive ones that are used in the defence industry…

They do this by over-producing. And capture the gains by dominating the refining and processing capacity of those metals. Chinese industries buy resources on the cheap thanks to a glut.

Trump’s solution to this is the precise opposite. To establish an artificially high price for those commodities in the West. This will encourage local production to kick into gear. Again, he’s partnering the state with corporations to help make it happen.

The profitable opportunity is obvious.

The problem is also obvious. Western corporations using those resources will be left paying high prices for them.

That’s what European companies are panicking about recently. If they have to pay higher energy prices for US oil and gas, their industries won’t be able to compete. Cheap Russian gas from pipelines is all that made them look viable in the past…

Unless Western politicians engineer higher artificial prices for Western corporations across the board, the effort to elbow out China will fail. More on how here.

Today, we consider the awkward political shift behind all this. Because we like awkward.

We’re all fascists now?

We all disagree about the purpose of the nation state. What’s in the remit and what’s not.

What’s changing about the world right now is whether protectionism is included in the package deal. Should the government use large corporations to steer the economy to achieve geopolitical aims?

In almost every part of the world except the US, protectionism was considered normal. The EU and China have all sorts of trade barriers and subsidies. Just look at how much Australians are complaining about our trade deal with the US right now.

Very few countries actually practiced free trade.

What’s changed is that the US is now willing to use the tools the rest of us have been using for decades. The US is giving the rest of the planet a taste of its own medicine on trade policy. Admittedly, in a rather stiff dose. But it’s still seen as retribution, not an attack. The whopping US trade deficit being the proof.

Strangely enough, the Japanese are understanding of this argument. Because their economic boom was based on the US permitting high amounts of protectionism to help Japan develop economically. Now, the Japanese acknowledge, it’s time to rebalance.

The EU also signalled it was willing to accept that trade had been unfair. It’s why the deal with the US is seen as an EU surrender. Trump merely gave the Europeans a taste of their own medicine.

I use this strategy all the time. When the kids are having a tantrum, my wife and I just join in. We throw ourselves on the floor, wiggle our limbs about and wail. It works brilliantly on the kids. They shut up. The rest of the supermarket does too.

Trump’s tariff tantrum seems to be working too. It mortifies onlookers. But hits the nail on the head by exposing hypocrisy.

All we can hope for now is that everyone wakes up to the benefit of rolling back unfair trade practices in coming years. Not just the US, everyone.

While we wait, it’s time to profit from the attempt to dislodge our mining industry from global prices.

Regards,

Nick Hubble,

Editor, Strategic Intelligence Australia

All advice is general advice and has not taken into account your personal circumstances.

Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

Nick Hubble found us at Fat Tail Investment Research in 2010 after a stint inside Wall Street’s most notorious bank, Goldman Sachs, during the 2008 GFC. That’s where he saw the true nature of the investment banking business. Since then, he’s been the editor of the Daily Reckoning Australia and the UK-based Fortune & Freedom and Gold Stock Fortunes.

He’s delighted to work as Investment Director and Editor for Jim Rickards’ Strategic Intelligence Australia. Here he helps turn Jim’s big-picture views into specific actionable advice and ideas for Australian investors.