Markets react to news headlines, but long-term returns are driven by earnings growth, so it’s worth paying attention to the second quarter US earnings season

About one-third of companies in the US have now reported their earnings, with somewhat mixed results for the S&P 500 overall. While an impressive 80% of companies have beaten expectations with reported earnings, the average magnitude of those beats is lower than normal. Earnings growth has also slowed, the Q2 2025 year-on-year S&P 500 earnings growth now sits at 6.4%1.

Despite this, the S&P 500 and Nasdaq 100 are around all-time highs on positive sentiment on two key themes:

- Worst case outcomes on tariffs avoided: With 15% tariff deals agreed with both Japan and the EU, an out and about trade war appears to have been avoided. While tariffs are much higher than pre-Liberation Day at least there is greater certainty – everyone now knows the rules of the game.

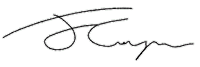

- AI adoption by US businesses is taking off: If AI can deliver a productivity dividend, and massive capex spend on AI data centres and infrastructure has a stimulatory effect, it will likely benefit the US economy as a whole, not just the hyperscalers.

Share of US businesses with paid subscriptions to AI models, platforms, and tools by sector

Source: Card spend data from Ramp; U.S. Census Business Trends and Outlook Survey

With this optimism, it’s not surprising to see investors attracted to the riskier parts of the equity market. Meme stocks are back in vogue and the increase in SPAC IPO2 activity are bringing back risk on sentiment. However, at times like this, it’s wise to pay attention to fundamentals.

In this article we examine some key themes in US equities, and how the last 3 months have created tailwinds for the Nasdaq 100 and why it’s uniquely placed going forward.

1. AI is here to stay but the Magnificent 7 is becoming an irrelevant concept

AI model performance has improved dramatically over the last year, and 2025 appears to be the year where businesses beyond the tech industry are jumping on board. For example, Google’s AI models processed over 980 trillion tokens in June, more than double the volume from May.

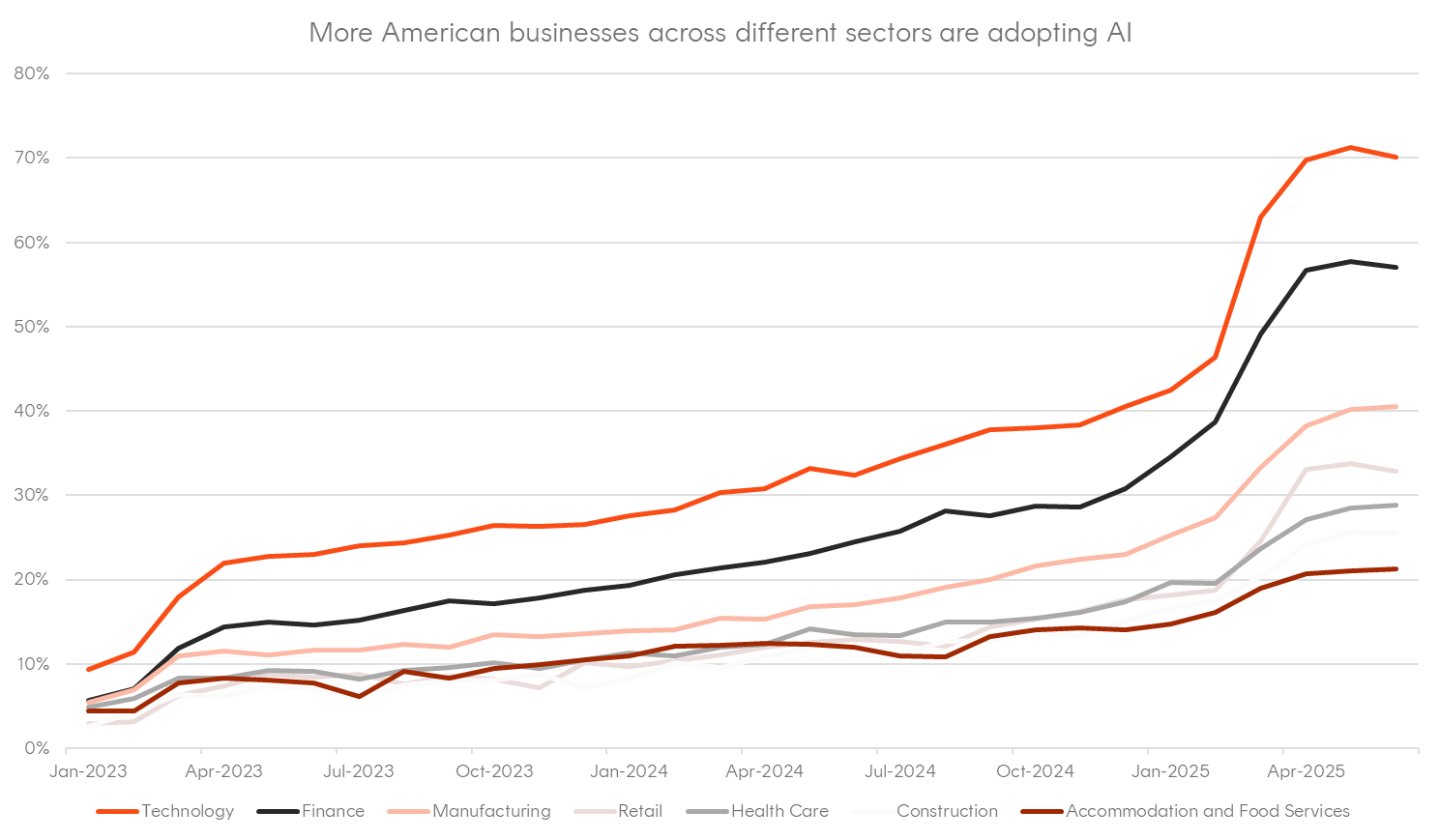

Yet the Magnificent 7 stock prices are no longer acting like a homogeneous group. The decoupling this year can be seen in the chart below. The best performing company in this cohort is Nvidia whose share price is up 28%. Tesla’s is down 14% as markets come to the realisation that its business model is fundamentally different to the other Mag 7 names. Apple has also lost touch with the pack after facing delays in rolling out AI features that have generally underwhelmed users. The company is under increasing pressure to make a big AI acquisition to catchup to others like Meta and Microsoft.

There has been significant return dispersion among the “Magnificent 7” companies this year

Source: Bloomberg. As at 24 July 2025.

Non-Mag 7 names like Broadcom, Palantir and Netflix have taken over leadership from the likes of Apple and Tesla, as investors switch to companies that have shown stronger evidence of AI related earnings growth. As with the development of any new technology, new leaders can be expected to emerge over time.

2. Dollar Weakness is Good for US Tech

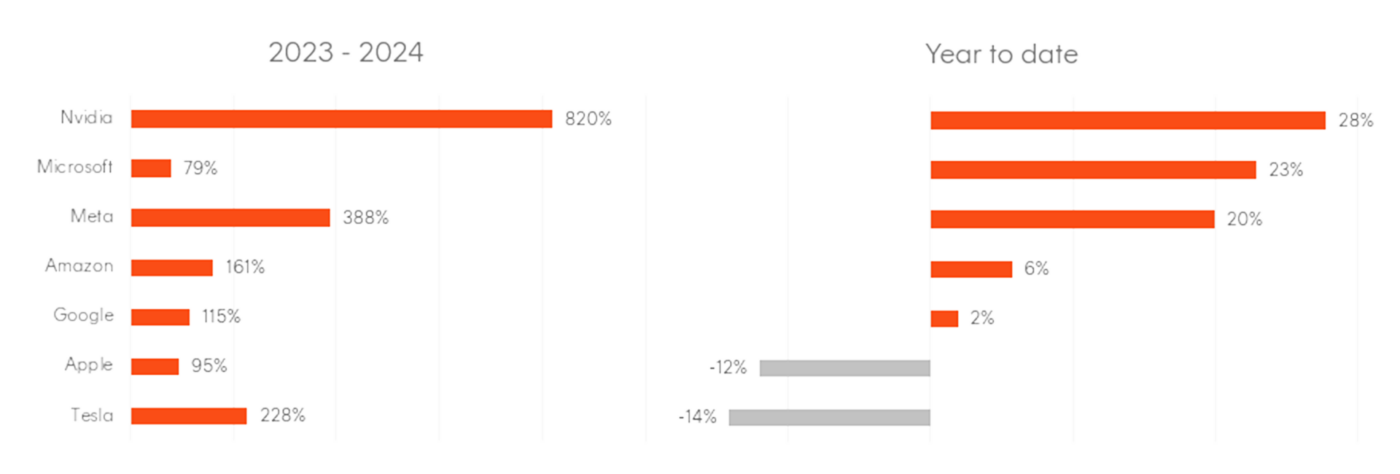

Recent weakness in the US dollar could provide a tailwind for companies with high exposure to international sales, compared to those with more domestic US sales. This is because a weaker US dollar boosts reported earnings when foreign sales are converted back into dollars.

The Nasdaq 100 generated 45% of revenues outside of the US in 2024, meaning companies within the index could receive an above-average tailwind from USD weakness, but may also be more exposed to any escalation in trade conflict.

Source: FactSet, Company 10-K filings, Goldman Sachs Global Investment Research. As of 2024.

The poster child for this foreign exchange tailwind is Netflix, which earned ~56% of revenue in 2024 from outside the US. Netflix recently raised its full year earnings guidance during their latest earnings call, though stated it “primarily reflects the foreign exchange impact from the weakening dollar relative to most other currencies.”

3. Tariff resolution removes retaliation risk for US Tech

But a high share of foreign revenue is also a potential vulnerability. One threat overhanging US Tech was the possibility of retaliatory actions from the EU; in particular, had an acceptable trade deal not been struck. Trump warned against going after US Tech whenever that threat was raised, and with negotiations now on a friendlier footing this risk appears to be off the table.

The Trump administration also delivered another win for US Tech in the OECD negotiations over the proposed Section 899 “revenge tax”. This new revenge tax would have hit foreign investors holding US investments, but global pension funds lobbied to have it removed. Treasury Secretary, Scott Bessent, agreed, but in return won an exemption for US multinationals from Pillar Two global minimum tax standards. This exemption makes it easier for US Tech companies to reduce their tax liability by locating certain business activities in low tax jurisdictions.

Overall, Big Tech’s solidarity with the new Administration on Inauguration Day appears to be paying off handsomely.

4. A silver lining from Trump’s Big Beautiful Bill

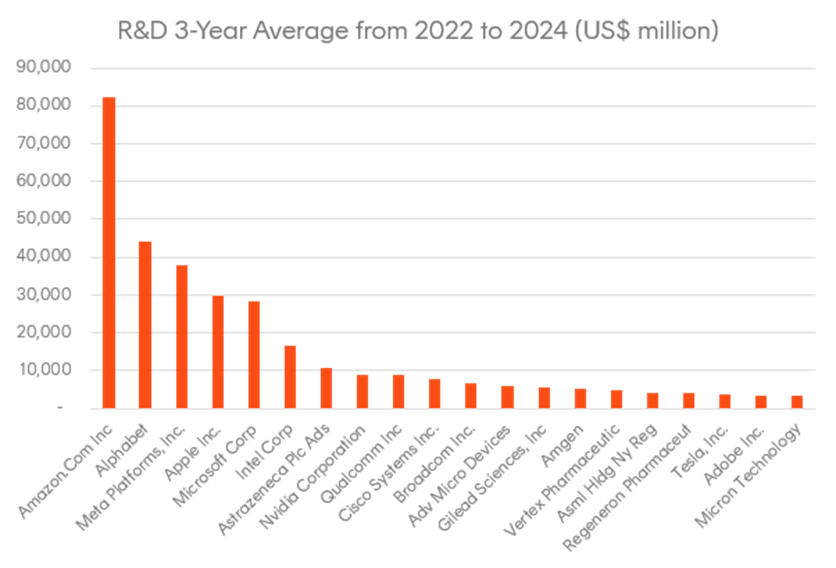

Trump’s One Big, Beautiful Bill Act (OBBBA) includes an incentive to encourage companies to spend more on R&D.

This incentive allows companies to immediately expense domestic research and development (R&D) costs, in turn reducing both taxable income and tax payments. This change is expected to provide a meaningful boost to free cash flows for companies investing heavily in innovation, benefiting technology companies such as Amazon, Alphabet, and Meta.

Source: Nasdaq Global Indexes, FactSet.

5. Fed easing cycle

Many investors would be familiar with the inflation shock of 2022 and ensuing interest rate hiking cycle that saw tech heavy indices like the Nasdaq 100 fall considerably that year.

However, with Chair Powell’s term due to officially end in May 2026 and under pressure from Trump, it’s likely the next move on rates will be down, not up. Additionally, the announcement of trade deals with Japan and the EU pulls forwards a resolution on the inflation path and provides the Federal Reserve more certainty around future interest rate decisions. When interest rates eventually fall, growth-oriented companies will likely benefit from lower costs of capital, increasing the value of future cash flows and raising valuations.

Additionally, looser monetary policy should ease financial conditions and make it easier for technology firms to invest in research & development, talent, and acquisitions.

6. The Nasdaq is growing beyond the big end of town

After a strong run in global markets the elevated level of index valuations naturally has come into focus. But high valuations are not a barrier to further upside when there is strong earnings momentum. As highlighted in our recent Quarterly Equity Commentary, earnings in the US have been more resilient than those of Europe or Australia.

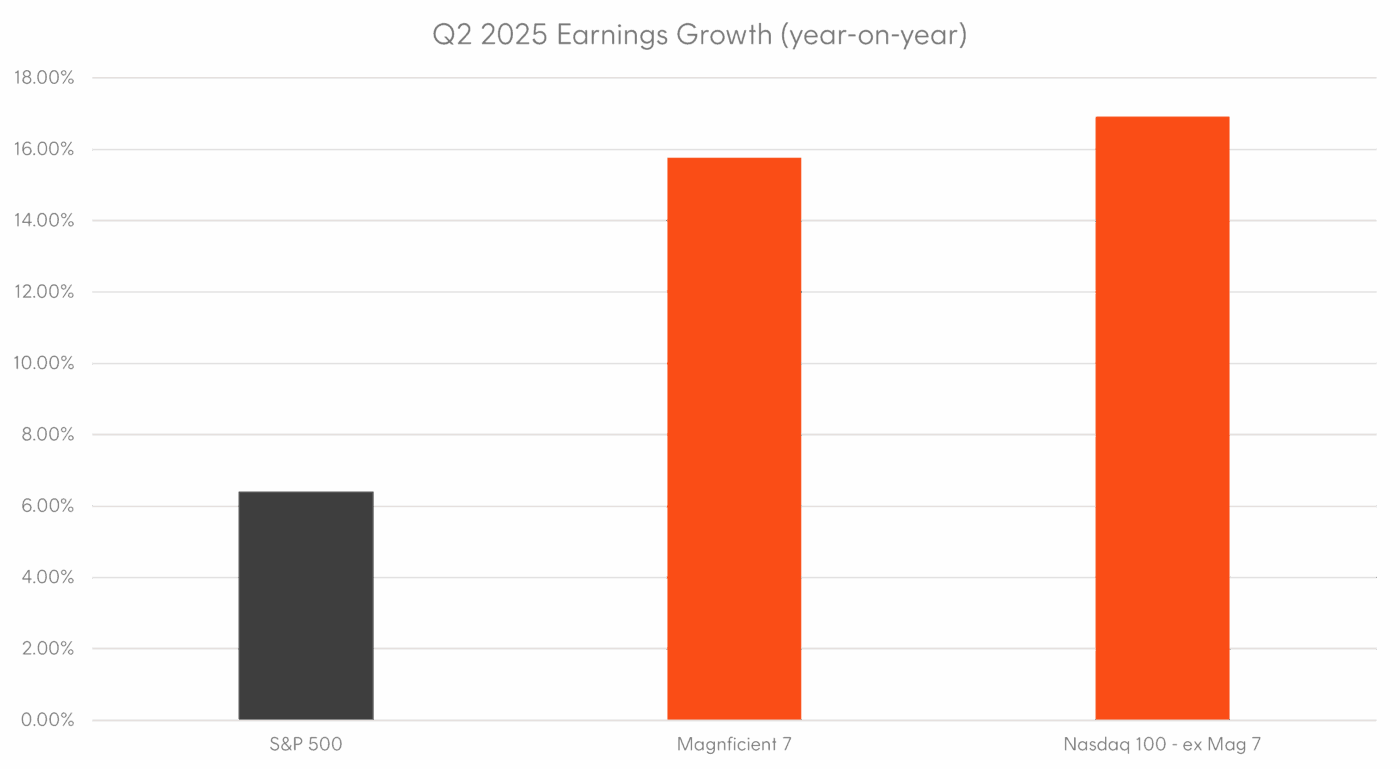

Earlier in this note, we pointed out the mid-single digit growth that is expected for the S&P 500 Index for Q2 2025. But what does growth look like for the Magnificent 7 and Nasdaq 100 Index more broadly?

Source: Bloomberg, Nasdaq Index Research. As at 25 July 2025.

While Magnificent 7 earnings growth remains above 15% (YoY for Q2 2025), the remainder of the Nasdaq 100 is actually growing faster, at 16.9%.

Investment implementation: AI exposure beyond the Mag 7

In our view, AI, currency and earnings growth provide strong tailwinds for the Nasdaq 100. While the index is up 22.5% year-to-date, the forward PE ratio is around its long-term average at 27.5x. With higher rates unlikely, the threat of trade sanctions and retaliatory measures lifted, plus support from the White House, our view is the Nasdaq 100 has significant potential upside from here.

Importantly, as the AI narrative is broadening out beyond the Magnificent 7, investors can invest in

NDQ

Nasdaq 100 ETF

to also get exposure to names like Broadcom, Netflix and Palantir. NDQ has returned 20.13% p.a. for the 10 years to 30 June 2025, making it the best performing large cap equity fund available in Australia over that period.

Sources:

1. FactSet Earnings Insight, John Butters, 25 July 2025 ↑

2. SPAC (special purpose acquisition company) IPOs provide private companies a way to go public by merging with a publicly traded shell company that was specifically created for this purpose. ↑

3. Returns are calculated in Australian dollars using net asset value per unit at the start and end of the specified period and do not reflect brokerage or the bid ask spread that investors incur when buying and selling units on the ASX. Returns are after fund management costs, assume reinvestment of any distributions and do not take into account tax paid as an investor in the Fund. ↑